Like in any other realm, Wall Street goes through trending cycles. Some industries are considered “hot stocks,” while others lose their glamour and investors’ attention. For example, in today’s climate, AI is the new “black gold.” Of course, there’s also the EV industry, which creates buzz and excitement from all corners of the globe. NIO (NIO) is one such company that is creating buzz and attention in the rising EV sector, and if you’re a fan of “The Matrix,” Even its name – NIO – suggests it’s the “One.” Ok, with a slight change. However, NIO faces challenges in the local and global Chinese markets, and it hasn’t become the ‘One’ its investors would have hoped for.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The electric vehicle industry has become a competitive industry with no margin for error, and if a company wishes to succeed, it needs to stand out, not just by its grand name. NIO does possess the technology trait to distinguish itself from other EV companies: Its swapping battery technology separates it from other players in the industry, making it a prime candidate for future success in the minds of potential investors.

However, things haven’t gone according to plan so far, and NIO is having difficulty propelling its operations and gaining consumer attraction. The company has improved in terms of sales, but its bottom line still looks bleak, and the road to profitability is still far away, 2027, according to some Wall Street analysts. Nevertheless, Green energy is the new trend for investors, and betting on a company to succeed in this industry is a compelling incentive.

Our writers at Tipranks, Casey Dylan and James Fox, have written extensively about NIO’s fortunes. You can read their articles here and here. For now, let’s examine three challenges keeping NIO from becoming a big-time player in the EV industry.

- Dependency on Chinese Economic Stimulus: NIO’s stock recorded a 35% rise during the month of September after the Chinese government declared an RMB800 billion lending pool to help revive the Chinese economy. However, as soon as it turned out the stimulus funds would be much lower than initially planned, the stock took a downturn of 31% between the second of October and the 24th. With hardly any presence outside China, the NIO’s reliance on the Chinese is alarming to some analysts.

- Continued Cash Burn and Financial Losses: NIO recorded its best delivery month in September, supplying 21,181 vehicles, including 832 of its brand new ONVO sub-brand, which targets mid-range consumers aspiring for an EV vehicle. Despite the impressive delivery numbers, NIO bleeds cash heavily. The company reported a staggering net loss of $705.4 million in Q2 2024, with operational costs growing faster than its revenue growth, putting it in an impossible financial state, where it’s trying to produce and sell more vehicles. Still, operational costs continue to hinder its bottom-line profits.

- Geopolitical and Market Expansion Challenges: NIO’s market share in China accumulates to only 2.1%, far behind EV brands like BYD (BYD), which holds a 35% market share, or even Tesla (TSLA), with 7.8%. The problem continues when looking abroad, where geopolitical tensions rise worldwide, and merchant war between China and the U.S. and Europe creates difficulties for Chinese companies to be adopted in the West with inflated tariffs and other regulatory obstacles.

What Is the Price Target for NIO?

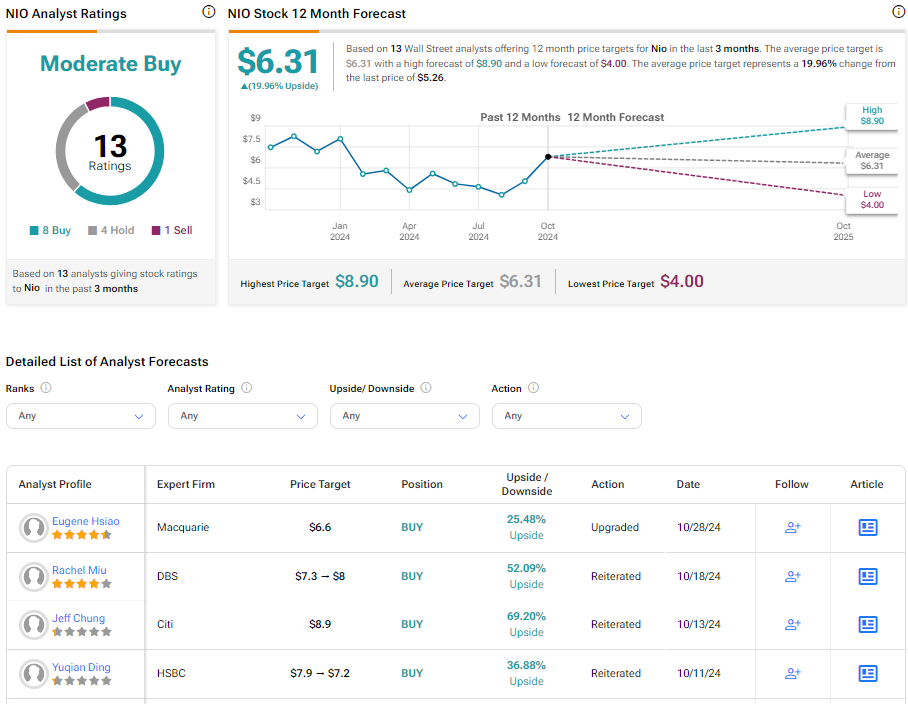

NIO is a Moderate Buy on Wall Street, with Eight Buys, Four Holds, and One Sell. The average price target for NIO stock is $6.31, reflecting 19.96% upside.

Conclusion

The EV industry is very trending among investors, and while many companies are creating buzz, only a few actually make the cut and make a difference. NIO has all the traits to be the big-time player with its changeable battery and with its new ONVO sub-brand intended for mid-range bound customers. However, the company continues to lose money, and a lot of it, while turning profitable, looks like a pipe dream, with analysts pointing towards 2027 as the year it might turn cash burn into a cash machine. Also, its meager market share in its home court in China and the obstacles set by the United States and Europe make it very hard for the company to grow its consumer base. It is still a good stock to watch for, and with a name like “NIO,” one would hope it can become the chosen vehicle for the masses.