NetApp (NTAP) is an American software company. It offers data solutions that enable customers to run their applications optimally across the data center and cloud environments.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

NetApp recently acquired Fylamynt to boost its cloud solutions. Fylamynt offers solutions that make it easier for customers to build, run, and manage their workflows in the cloud.

For its Fiscal Q3 2022 ended January 28, NetApp reported revenue of $1.61 billion, which rose from $1.47 billion in the same quarter the previous year and matched the consensus estimate. It posted adjusted EPS of $1.44, which improved from $1.10 in the same quarter the previous year and beat the consensus estimate of $1.28.

NetApp ended the quarter with $4.2 billion in cash. It plans to distribute a quarterly dividend of $0.50 per share on April 27 to shareholders of record on April 8. NetApp stock currently offers a dividend yield of 2.48%, compared to the sector average of 0.69%.

With this in mind, we used TipRanks to take a look at the risk factors for NetApp.

Risk Factors

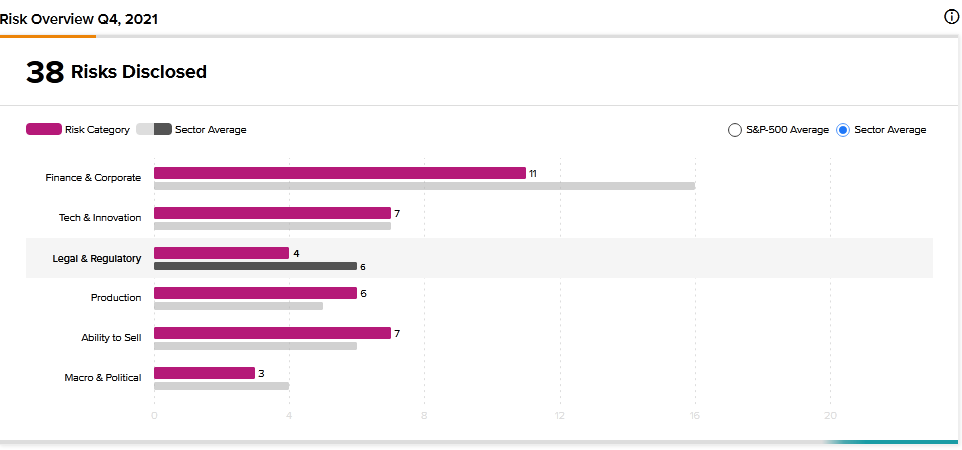

According to the new TipRanks Risk Factors tool, NetApp’s top risk category is Finance and Corporate, with 11 of the total 38 risks identified for the stock. Tech and Innovation and Ability to Sell are the next two major risk categories, each with 7 risks.

In a newly added Finance and Corporate risk factor, NetApp informs investors that it has recently adopted a new segment reporting structure. As a result, it now has two reportable segments, namely Public Cloud and Hybrid Cloud. It previously had only one reportable segment.

The company explains that the new structure is intended to reflect how management allocates resources and assesses performance. However, it cautions that the changes may not result in the desired effect and that it may need to further modify its segment reporting structure in the future. Additionally, it warns that it may incur additional costs that could adversely affect the implementation of the new reporting structure.

In another Finance and Corporate risk factor, NetApp tells investors that it carries about $2.7 billion in debt in the form of notes maturing between 2022 and 2030. The company says it may incur additional debt in the future. NetApp cautions that if it is unable to generate sufficient cash flow to service its debts, it could run into problems that could harm its business and financial condition.

Moreover, NetApp says that the debts come with conditions that may restrict its operational and strategic flexibility in the future. Additionally, NetApp warns that if servicing the debt becomes a problem, its credit rating could be downgraded, which would harm its ability to obtain additional financing in the future.

NetApp’s stock has gained about 31% over the past 12 months.

Analysts’ Take

In February, Susquehanna analyst Mehdi Hosseini reiterated a Buy rating on NetApp stock and raised the price target to $110 from $105. Hosseini’s new price target suggests 36.90% upside potential.

Consensus among analysts is a Moderate Buy based on 6 Buys, 4 Holds, and 1 Sell. The average NetApp price target of $98.27 implies 22.30% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Related News:

Algonquin Power & Utilities 2021 Revenue Rises 36%

AltaGas Q4 Revenue Nearly Doubles, Swings to Loss

Curaleaf Q4 Revenue Rises 39%, Loss Shrinks