Wells Fargo & Company (NYSE:WFC) is set to release its second quarter Fiscal 2024 results on Friday, July 12, before the market opens. The Street expects WFC to report diluted earnings per share (EPS) of $1.29 on revenues of $20.26 billion. This compares favorably to the Q2FY23 figures, when WFC posted diluted EPS of $1.25 on total revenues of $20.5 billion.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Wells Fargo is a diversified financial services company, offering an array of traditional banking, insurance, wealth management, mortgage banking, and advisory services.

Wells Fargo Boasts a Solid Earnings History

Remarkably, WFC has beaten earnings estimates in six of the eight consecutive quarters, implying a high probability of beating consensus this time around.

Like all banks, WFC’s net interest income (NII) continues to remain under pressure due to higher financing costs. Even so, this decline is offset by higher fee income, trading revenue, and other noninterest income, as noted by the company in Q1FY24 results.

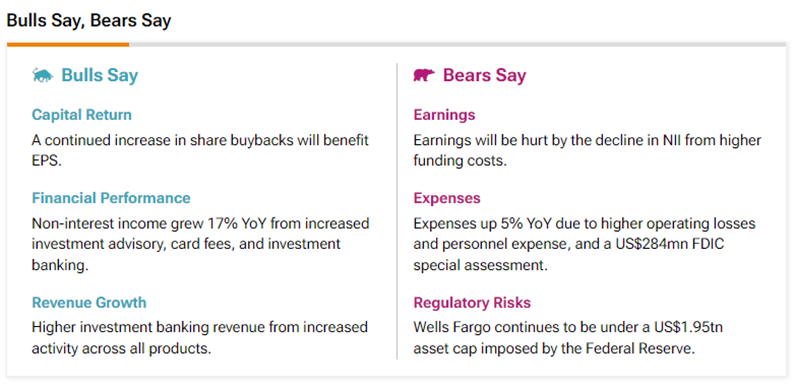

Insights From TipRanks Bulls Say, Bears Say Tool

According to TipRanks’ Bulls Say, Bears Say tool, Wells Fargo’s top line is benefiting from higher demand for its investment banking and advisory services. Moreover, WFC continues to increase its share buyback program, which enhances shareholders returns. Also, WFC pays a regular quarterly dividend of $0.35 per share, reflecting an above-sector average yield of 2.35%.

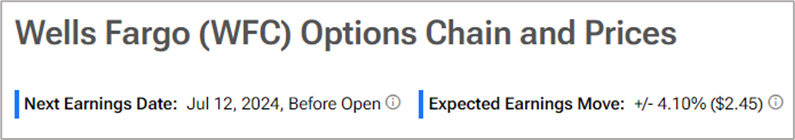

Options Traders Anticipate a Minor Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a 4.10% move in either direction.

Learn more about TipRanks’ Options tool here.

Is Wells Fargo Stock a Buy or Hold?

Analysts remain divided on Wells Fargo’s stock trajectory. On TipRanks, WFC stock has a Moderate Buy consensus rating based on nine Buys versus nine Hold ratings. The average Wells Fargo & Company price target of $63.96 implies 7.1% upside potential from current levels. Meanwhile, WFC shares have gained 22.9% so far this year.