It was a fairly decent day for healthcare stock WELL Health Technologies (TSE:WELL), as it turned in a third-quarter earnings report that may not have impressed but didn’t let anyone down very far. WELL Health gained fractionally in Tuesday afternoon’s trading as a result of its comparative win.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

WELL Health posted C$204.5 million in revenue and also turned in record-high earnings before interest, taxes, depreciation, and amortization (EBITDA) of C$28.2 million. Its adjusted EBITDA from Canadian operations, meanwhile, came in at $12.3 million, which represented a 24% jump over 2022’s third quarter. It even went so far as to bolster its guidance, noting that Fiscal Year 2023 figures will come in between C$755 million and C$765 million, thanks in large part to rising expectations of “organic growth” throughout the year.

Organic Growth Backed Up by New Acquisitions

Give WELL Health some credit here; it’s not just crossing its fingers and wishing really hard that “organic growth” will be a thing. It recently picked up two new cybersecurity businesses—Seekintoo and Proack—in a pair of deals. Though the values of the deals weren’t disclosed, having a finger in the cybersecurity pie can seldom hurt. We’ve already seen how businesses, hesitant to spend in these uncertain conditions, are still willing to spend to protect their files and their customers. And though the earnings picture hasn’t always been rosy for WELL Health, it’s still making headway and posting gains, which should be good news as long as it can keep going.

Is WELL a Good Stock to Buy?

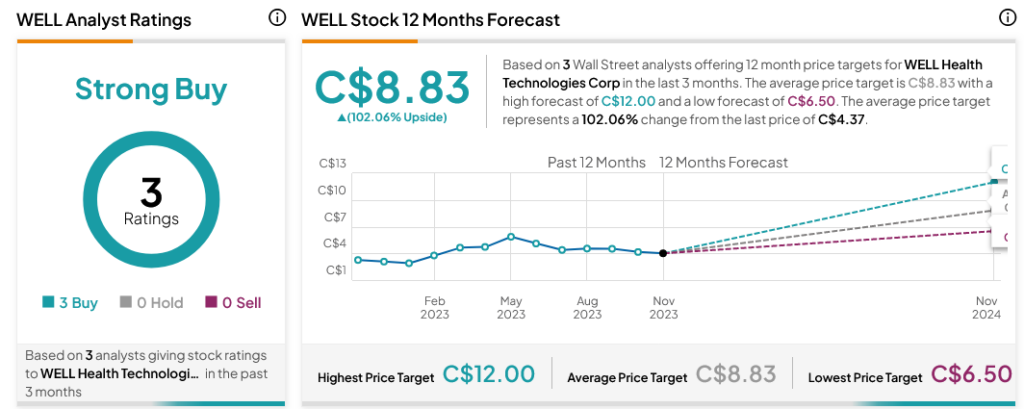

Turning to Wall Street, analysts have a Strong Buy consensus rating on WELL stock based on three Buys assigned in the past three months, as indicated by the graphic below. After a 42.48% rally in its share price over the past year, the average WELL price target of C$8.83 per share implies 102.06% upside potential.