These are the two Canadian penny stocks to buy in April 2024, as per analysts. Based on analysts’ consensus price targets, both WELL Health Technologies Corp. (TSE:WELL) and TerrAscend Corp. (TSE:TSND) have high upside potential in the next twelve months. In Canada, a penny stock is defined as a company whose shares are trading at less than C$5 per piece.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

A penny stock has the potential to generate outsized returns. However, penny stock price movements are very volatile in nature and could lack transparency in cases where they trade over the counter (OTC). Considering these factors, let’s dive right into the two penny stocks that we have sorted based on analysts’ recommendations.

WELL Health Technologies Corp. (TSE:WELL)

British Columbia-based WELL Health Technologies is a digital health market leader. It offers healthcare providers technology and services designed to enhance productivity and improve patient healthcare outcomes. WELL is Canada’s largest owner and operator of outpatient health clinics, with operations in Canada and the U.S.

In Fiscal 2023, WELL reported record revenue of C$776.05 million, up 36% annually. However, adjusted earnings dropped 2% to C$0.22 per share compared to FY22. For FY24, WELL lifted its annual revenue guidance to the range of C$950 million to C$970 million, showing a 25% jump. The company continues to grow its business by acquiring physical and digital healthcare assets, operating a predictable revenue model, and generating solid positive cash flows.

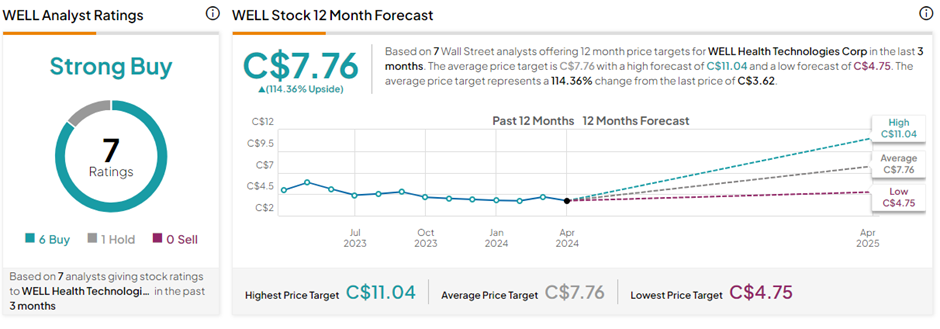

Is WELL Stock a Good Buy?

On TipRanks, WELL stock commands a Strong Buy consensus rating based on six Buys versus one Hold rating. The average WELL Health Technologies price target of C$7.76 implies 114.4% upside potential from current levels. In the past year, WELL shares have lost 33.8%.

TerrAscend Corp. (TSE:TSND)

TerrAscend is focused on producing and marketing cannabis-related products and services for both medical and legal adult-use markets. It has vertically integrated operations in Pennsylvania, New Jersey, Maryland, Michigan, and California and retail operations in Canada. The company has both retail locations and scaled cultivation, processing, and manufacturing facilities in its core markets.

In FY23, TerrAscend’s net revenue jumped 28% to $317.33 million. Also, the company delivered its first full year of positive cash flows. Meanwhile, TerrAscend’s net loss from continuing operations reduced significantly to $0.33 per share from a loss of $1.24 per share in FY22.

TerrAscend is scheduled to release its Q1 FY24 results on May 9, after the market closes. The Street expects TSND to post a diluted loss from continuing operations of $0.03 per share on net revenue of $112.34 million.

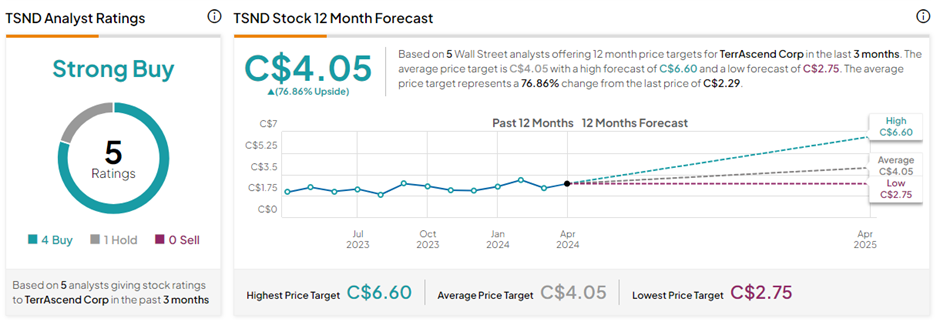

What is the Future of TerrAscend Stock?

On TipRanks, TSND stock has a Strong Buy consensus rating based on four Buys and one Hold rating. The average TerrAscend price target of C$4.05 implies 76.9% upside potential from current levels. In the past year, TSND shares have lost 6.5%.

Ending Thoughts

Analysts believe the above two Canadian penny stocks have huge upside potential over the next twelve months. Investors seeking exposure to high-risk, high-reward penny stocks can consider investing in them after thorough research.