Berkshire Hathaway (BRK.B) has agreed to buy Alleghany Corporation (Y) in a $11.6 billion cash deal. BRK.B shares were up 2% and closed at $349.66 on March 21.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Warren Buffett-led Berkshire is a holding company of businesses involving a diverse range of sectors, including insurance, energy, and transportation.

Meanwhile, Alleghany is a property and casualty insurance provider. The deal values Alleghany at $848.02 per share, a premium of 29% over the company’s average share price in the previous 30 days.

The transaction is expected to close in Q4 2022 subject to approval from regulators and Alleghany shareholders. Alleghany’s Chairman of the Board, Jefferson W. Kirby controls 2.5% of the company’s common shares, and has agreed to vote in favor of the deal.

Alleghany’s Approval

Although Alleghany’s Board has approved the Berkshire deal, the company has a 25-day “go-shop” period to seek alternative acquisition offers. If Alleghany gets a superior takeover proposal within the go-shop period, then it can terminate the agreement with Berkshire.

Meanwhile, if Alleghany proceeds with the Berkshire offer and the transaction closes successfully, then it would operate as an independent business within the Berkshire conglomerate and would also benefit from increased capital strength.

Berkshire CEO and Chairman, Warren Buffett, said, “Berkshire will be the perfect permanent home for Alleghany, a company that I have closely observed for 60 years.”

Analysts’ View

Consensus among analysts is a Moderate Buy based on one Buy. The average analyst price target for BRK.B stands at $364, which implies upside potential of 4.1% to current levels, at the time of writing. Shares have gained 4% over the past year

News Sentiment

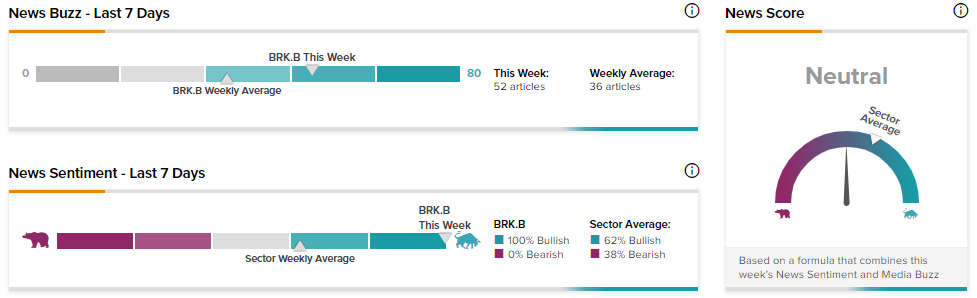

TipRanks’ data shows that the News Score for Berkshire Hathaway is currently Neutral based on 52 articles published over the past seven days. Notably, none of the articles have a Bearish Sentiment compared to a sector average of 38%, while 100% of the articles have a Bullish Sentiment compared to a sector average of 62%.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Tencent Music Drops 2.8% Following Mixed Q4 Results

Columbus McKinnon Rewards Shareholders with 17% Hike in Quarterly Dividend

IGT Signs Six-Year Contract with Singapore Pools; Street Says Buy