Warner Music Group Corp. (NASDAQ: WMG) reported stronger-than-expected fiscal Q1 results, topping both earnings and revenue estimates driven by robust digital revenues and improved margins.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, despite the beat, shares of one of the largest music companies in the world dropped 6.9% on February 8 to close at $37.75.

Q1 Numbers

Adjusted earnings of $0.36 per share doubled year-over-year and beat analysts’ expectations of $0.29 per share. The company reported earnings of $0.18 per share for the prior-year period.

Revenues jumped 21% year-over-year to $1.61 billion and exceeded consensus estimates of $1.49 billion. The increase in revenues reflected a 21.5% surge in digital revenue across recorded music and music publishing.

Management Weighs In

Warner Music Group CEO, Steve Cooper, commented, “In the coming year, we look forward to welcoming back huge superstars, breaking new artists and songwriters, and seeking out more innovative ways to bring more music to more people in more places.”

Warner Music Group Acting CFO Lou Dickler added “We’re committed to making sustained investments in our core business, and to taking pioneering steps that position WMG for the next wave of growth, all with a financially disciplined, ROI-focused perspective.”

Wall Street’s Take

Following the Q1 earnings, Truist analyst Matthew Thornton decreased the price target on the stock to $51 (19.2% upside potential) from $45 and reiterated a Buy rating.

Despite Thornton’s belief that Warner Music’s risk-reward has “improved”, he decreased the price target to align the stock’s valuation with peers.

Overall, the stock has a Moderate Buy consensus rating, based on 8 Buys, 3 Holds, and 1 Sell. At the time of writing, the average Warner Music Group price target was $48, which implies 27.15% upside potential to current levels.

Investors Weigh In

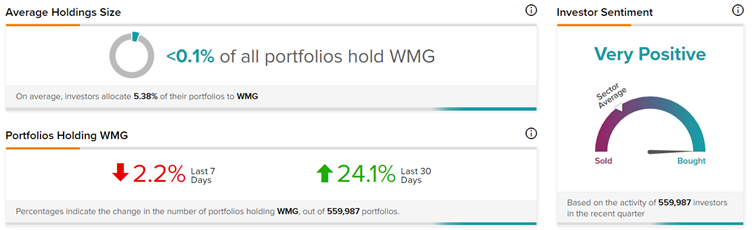

According to TipRanks’ Stock Investors tool, investors currently have a Very Positive stance on Warner Music, with 24.1% of investors increasing their exposure to VER stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Royal Caribbean’s Sail to Profitability Delayed; Shares Plunge 4.8%

Boyd Gaming Delivers Q4 Beat & Resumes Dividend; Shares Up 6.5%

Spectrum Brands Acquires Tristar Products’ Appliance and Cookware Business