Broadcom (AVGO) stock has risen more than 51% year-to-date, driven by artificial intelligence (AI)-led demand for the company’s custom ASICs (application-specific integrated circuits) and networking solutions. However, AVGO stock has declined more than 7% over the past month amid concerns about the payoffs on the hefty AI spending by tech giants. Also, worries about margin pressures overshadowed Broadcom’s market-beating Q4 FY25 results. Nonetheless, Wall Street is bullish on AVGO stock and sees solid upside potential in 2026, backed by a robust demand backdrop for the company’s AI chips and networking offerings.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Benchmark Analyst Is Bullish on Broadcom’s Growth Prospects

Broadcom’s custom AI chips are seeing solid traction, providing customers an attractive alternative to Nvidia’s (NVDA) GPUs (graphics processing units). Investors have cheered the company’s recently announced massive contracts, including $21 billion worth of orders from Anthropic (PC:ANTPQ) for Alphabet-owned Google’s (GOOGL) TPUs (tensor processing units) and the partnership with OpenAI (PC:OPAIQ) to deploy 10 GW of AI processors. However, management’s commentary about a higher AI product mix impacting its margins and the lack of a full-year outlook for Fiscal 2026 led to post-earnings selloff.

Despite ongoing concerns, Benchmark analyst Cody Acree raised his price target for Broadcom stock to $485 from $385 and reaffirmed a Buy rating. Commenting on the post-earnings pullback, Acree noted that the selloff reflected profit taking after an impressive year-to-date rally, “almost regardless” of the strong earnings release. The 5-star analyst believes that there was a lot for investors to be impressed by in the company’s Q4 FY25 earnings, including the $21 billion in orders from Anthropic over the past two quarters and a six-quarter AI order backlog that has risen to $73 billion.

Acree added that Broadcom is the most direct beneficiary of Google’s successful effort to deploy its Ironwood TPUs for third-party use, with the list of clients comprising Apple (AAPL), Cohere, and SSI. The analyst highlighted that AVGO’s AI semiconductor business grew 25% sequentially and 76% year-over-year to $6.5 billion in Q4 FY25 and is expected to grow by 25% sequentially and more than double year-over-year to $8.2 billion in Q1 FY26. Aside from Broadcom’s custom XPU business, Acree also highlighted strength across the company’s networking, DSP, optical components, and switching businesses.

UBS Projects Strong Upside in AVGO Stock in 2026

Meanwhile, UBS analyst Timothy Arcuri increased the price target for Broadcom stock to $475 from $472 and reiterated a Buy rating following an investor meeting with management. The 5-star analyst thinks that the post-earnings selloff was a “significant overreaction by the market.” Arcuri raised his estimates based on management’s commentary on AI chip revenue for Fiscal 2026, which he now estimates to be more than $60 billion, or up nearly three times year-over-year. The analyst highlighted that management is very positive that the $73 billion AI backlog figure (over a period of 18 months) provided during the earnings call is “extremely conservative” and will be shipped in a timeframe closer to 12 months.

Is AVGO Stock a Buy, Sell, or Hold?

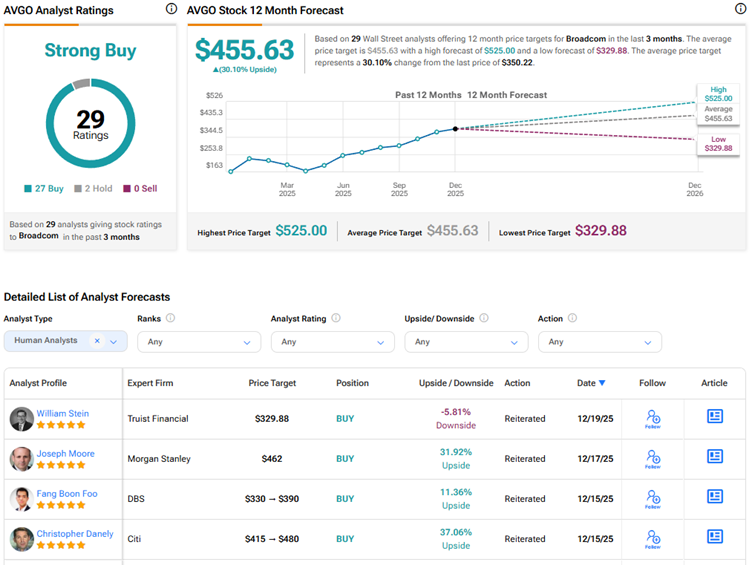

With 27 Buys and two Holds, Broadcom stock scores a Strong Buy consensus rating. The average AVGO stock price target of $455.63 indicates 30.1% upside potential.