Walgreens Boots Alliance (NASDAQ:WBA) divested its remaining stake in Option Care Health (NASDAQ:OPCH) for about $330 million. With these proceeds, WBA aims to pay off some of its debt obligations and invest in its strategic priorities.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Earlier in March, Walgreens sold Option Care’s 15.5 million shares at a price of $30.75 per share. This stake sale reduced WBA’s ownership from 14% to 6%. It is worth mentioning that Option Care was formerly known as Walgreens Infusion Services. The name change came after the unit was separated from Walgreens in 2015.

Not Just Option Care

In recent times, Walgreens has been divesting stakes in various businesses to generate liquidity for investments. Last month, WBA sold AmerisourceBergen’s (ABC) shares worth $694 million. Prior to this, Walgreens had already offloaded its ABC stock and raised proceeds of $1 billion in December 2022.

The company aims to establish a network of at least 600 primary-care clinics in over 30 U.S. markets by 2025, with a further goal of reaching 1,000 clinics by 2027. To achieve this objective, Walgreens made a substantial investment of $5.2 billion, resulting in its becoming the majority owner of VillageMD, a primary care provider.

Is WBA a Buy or Sell?

Interestingly, Walgreens is a dividend aristocrat and has been raising dividend amounts for about 30 consecutive years. It currently boasts an attractive dividend yield of 6.1%. Nevertheless, WBA’s strategy to diversify offerings has resulted in a large debt balance, which is impacting the bottom line.

Overall, Wall Street is sidelined on Walgreens stock, with a Hold consensus rating based on two Buys, eight Holds, and two Sells. The average WBA price target of $39.91 suggests 25.3% upside potential from the current levels. Shares have declined nearly 22% year-to-date.

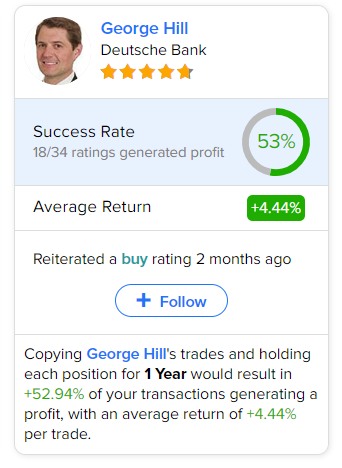

Investors looking for the most accurate and profitable analyst for WBA could follow Deutsche Bank analyst George Hill. Copying the analyst’s trades on this stock and holding each position for one year could result in 53% of your transactions generating a profit, with an average return of 4.44% per trade.