Wearable display technology solutions provider Vuzix Corporation (NASDAQ: VUZI) recently revealed that it has bagged a follow-on order of $200,000 from a Fortune 50 Online Retailer for Vuzix smart glasses to support training and remote maintenance within its warehouses.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the news, shares of the company declined almost 3% to close at $5.81 in Friday’s extended trading session. However, the fall can be attributed to wider market concerns.

The order follows the successful completion of a proof-of-concept (POC) earlier last year in one warehouse and the initial deployment of Vuzix smart glasses in 40 warehouses several months ago. This follow-on order will support the further deployment of glasses to the 40 warehouses as well as initial deployment to additional locations.

Management Commentary

The CEO of Vuzix, Paul Travers, said, “We are pleased to see a customer of this caliber, not only a retailer leader but also an innovative user of new technologies, continue to deploy and actively use Vuzix smart glasses, a proven productivity tool. This Fortune 50 customer represents just one of many exciting opportunities within this vertical, and we look forward to working with them, as well as others, to expand both the depth and breadth of Vuzix Smart Glasses usage this year and beyond.”

Stock Rating

Recently, Craig-Hallum analyst Christian Schwab reiterated a Buy rating on the stock. The analyst, however, lowered the price target from $30 to $11, which implies upside potential of 87.4% from current levels.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 2 Buys and 1 Hold. The average Vuzix stock prediction of $13 implies that the stock has upside potential of 121.5% from current levels. Shares have declined 57.3% over the past year.

Positive Sentiment

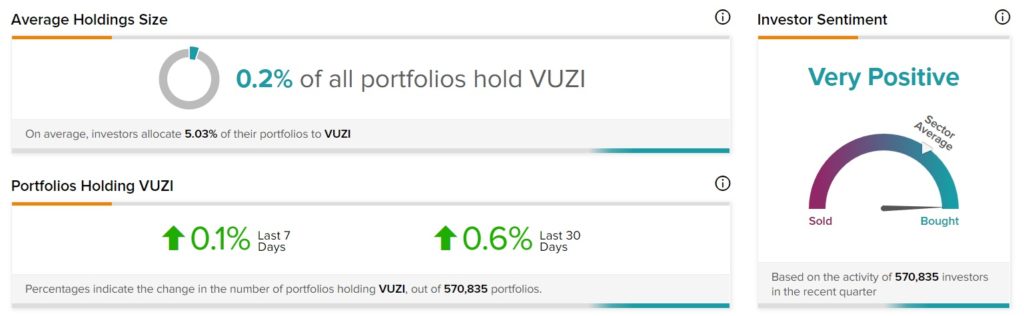

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on VUZI, as 0.6% of portfolios tracked by TipRanks increased their exposure to VUZI stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Welbilt Sells Manitowoc Ice Business to Pentair for $1.6B

SoFi Concludes Acquisition of Technisys

Broadcom’s Q1 Results Surpass Estimates; Street Says Buy