Shares of the UK-based Vistry Group PLC (GB:VTY) plummeted almost 20% as of writing after the company downgraded its full-year adjusted pre-tax profit guidance to £300 million, 15% lower compared to its previous forecast of £350 million. Moreover, the outlook reflects around a 28% decline compared to last year’s profit of £419.1 million. The downgrade stems from additional issues in the South Division and lower completion expectations for the year.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Vistry Group is a house-building company that has a presence in various segments of the UK housing market.

Vistry Issues Update on South Division Challenges

Along with its trading numbers, Vistry issued an update on the challenges in its South division. The company now expects these issues to cut its adjusted pre-tax profit by £165 million over three years, as compared to the previous estimate of £115 million. This includes an additional impact of £25 million in FY24.

In terms of house completions, the company now expects to deliver approximately 17,500 units for the full year, down from its prior guidance of 18,000.

Looking forward, Vistry holds a strong forward sales position of £4.8 billion, marking a 12% increase year-over-year.

Stifel Nicolaus Analyst Weighs In

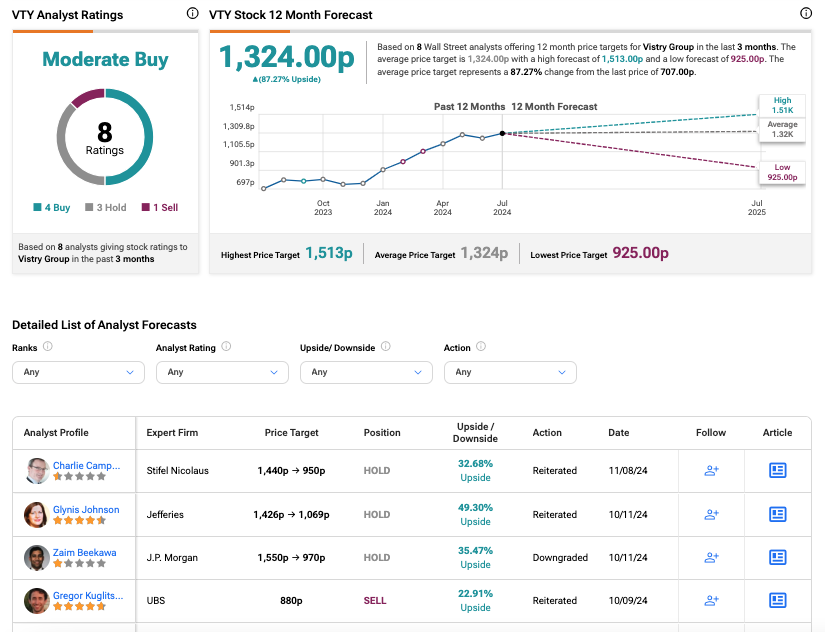

Following the update, analyst Charlie Campbell from Stifel Nicolaus maintained a Hold rating on the stock. He reduced his price target from 1,440p to 950p, predicting an upside of 33%.

Campbell believes the downgrades have raised concerns regarding management effectiveness and forecasting accuracy within the division. Nonetheless, Vistry Group remains well-positioned to capitalize on the government’s emphasis on affordable housing, especially as it shifts to an exclusively partnership-driven model.

Is Vistry a Good Share to Buy?

According to TipRanks, VTY stock has received a Moderate Buy rating based on a total of eight recommendations. This includes four Buys, three Holds, and one Sell rating from analysts. The Vistry share price target is 1,324p, which is 87.3% above the current trading levels.

Year-to-date, VTY stock has lost 22%.