Shares of Visa (V) and Mastercard (MA) are under pressure amid reports that Americans now owe a record $1.17 trillion on their credit cards.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

A new report on household debt from the Federal Reserve Bank of New York has found that credit card balances in the U.S. rose by $24 billion in this year’s third quarter and are up 8.1% from a year ago. Despite that growth, credit card delinquency rates have improved, with 8.8% of balances considered delinquent in Q3 compared to 9.1% in the previous quarter, said the New York Fed.

The average balance on a credit card in the U.S. now stands at $6,329, up 4.8% from a year ago compared with an 11.2% increase in 2023. In the past three months, 42% of Americans said their total debt hasn’t changed, while 28% have seen their debt rise, according to a separate survey by Achieve, which helps consumers manage their debt loads.

A Rebound in Credit Card Balances

American consumers have largely spent the excess savings they accumulated during the Covid-19 pandemic, leading to a rebound in credit card use and a rise in balances. Consumer spending remains strong despite high borrowing costs, with the average interest rate charged on a credit card now above 20%, an all-time high.

Consumers who were surveyed say the reasons they use credit cards is to make ends meet amid high inflation and interest rates, as well as to help them immediately after losing a job or seeing their wages reduced. Still, other people said that they use credit cards for discretionary purposes and to spend more when they are short of cash.

And although the U.S. Federal Reserve has begun lowering interest rates, the average interest rate charged on credit cards has yet to move meaningfully lower.

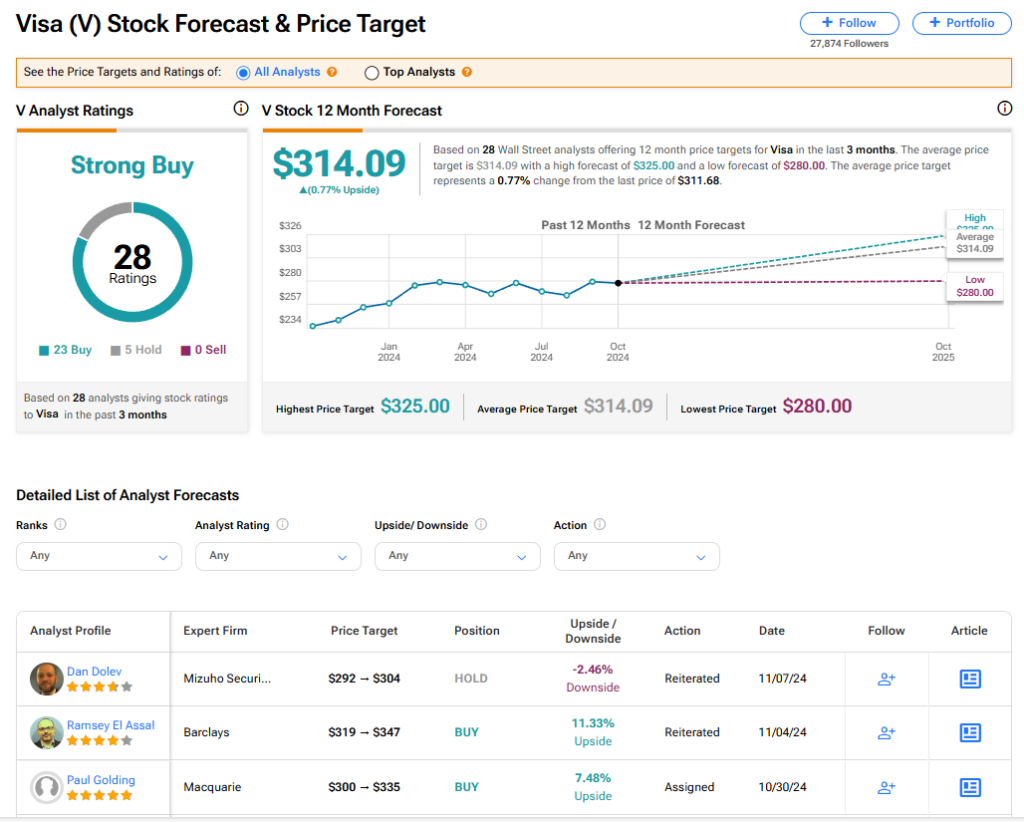

Is V Stock a Good Buy?

The stock of credit card giant Visa currently has a consensus Strong Buy rating among 28 Wall Street analysts. That rating is based on 23 Buy and five Hold recommendations assigned in the last three months. The average V price target of $314.09 implies 0.77% upside from current levels.