Digital payment services provider Visa, Inc.’s (NYSE: V) U.S. payments volume increased five points month-on-month in February 2022 to 145% of 2019. Credit volume rose seven points to 135% of 2019, and Debit volume remained flat month-on-month at 154% of 2019.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Card not present, excluding travel, climbed three points to 171% of 2019 and card present was 123% of 2019, up five points versus January 2022.

Payments volume in international markets increased several points month-on-month in most countries in February. Significant increases were noted in India, Canada, Brazil, Italy and Germany.

Processed transactions across the world climbed one point month-on-month in February to 139% of 2019.

In relation to Russia’s invasion of Ukraine, Visa said, “Visa is in the process of complying with all applicable global sanctions. As part of that compliance, we have suspended access to Visa for certain clients. It is difficult to reasonably estimate the full potential financial impact of this situation on Visa at this time.”

“In fiscal full-year 2021, total net revenues from Russia, including revenues driven by domestic as well as cross-border activities, were approximately 4% of Visa net revenues and total net revenues from Ukraine were approximately 1% of Visa net revenues,” the company added.

California-based Visa facilitates electronic funds transfers through Visa-branded credit cards, debit cards and prepaid cards.

Price Target

Based on 16 Buys and 3 Holds, Visa has a Strong Buy consensus rating. The average Visa price target of $273.47 implies 31.2% upside potential from current levels. Shares have lost 12.2% over the past six months.

Website Traffic

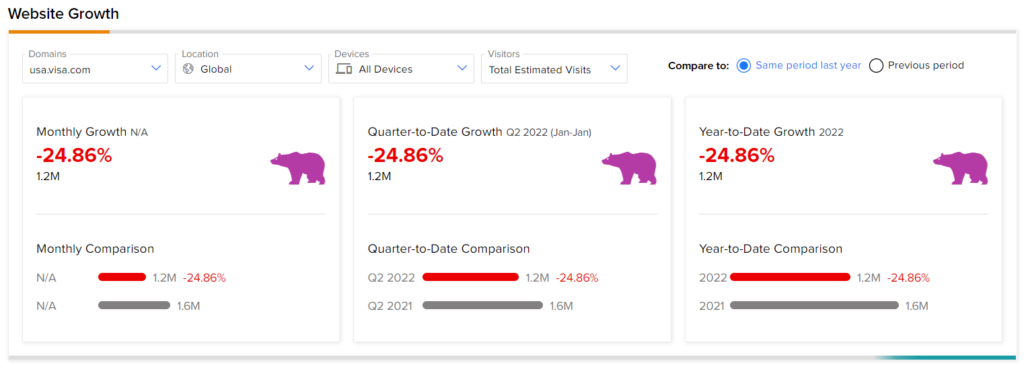

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Visa’s performance.

According to the tool, compared to the previous year, Visa’s website traffic registered a nearly 25% decline in global visits year-to-date.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

BMO Q1 Profit Rises 45%, Beats Estimates

First Solar Drops 16% on Revenues Miss & Muted Outlook

Lordstown Motors Slips 2.6% Pre-Market on GM Stake Sale Report