The stock of credit card giant Visa (V) fell last week after the U.S. Department of Justice accused the company of monopolizing debit card payments. V shareholders were hit hard by the news, but I believe this dip has created a buying opportunity. Visa remains the undisputed champion in the digital payments space and has one of the most secure payment networks in the world. The company helped pioneer the concept of “financial technology,” or fintech. For these reasons, I am bullish on Visa stock regardless of the U.S. government’s antitrust lawsuit.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

As illustrated in the chart below, V stock has risen 5.78% this year, trailing the 20% year-to-date gain in the benchmark S&P 500 index.

Visa Accused of Monopolizing Debit Payments

A big reason why I’m bullish on Visa stock is its wide moat and future growth potential. But, as I alluded to above, what led to the dip in V stock over the past week was the complaint filed by the Justice Department on September 24. According to the filing, Visa has been monopolizing debit card payments, putting pressure on merchants through anticompetitive pricing structures and signing deals with smaller competitors to limit innovation.

The Justice Department stated that Visa controls about 60% of the $4 trillion market for debit transactions in the U.S. and earns $7 billion in annual fees on those transactions. The complaint also states that Visa has been engaging in anticompetitive practices to keep competitors from gaining market share. The payments giant, according the government filing, imposes hefty fees on merchants if they do not route their debit payments through its network.

On top of that, Visa has signed lucrative deals with companies such as Apple (AAPL), PayPal (PYPL), and Block (SQ), to keep them from developing their own debit card products and instead use its network for routing debit card payments.

Visa is the Payments King

I remain bullish on Visa’s stock regardless of the U.S. antitrust action. The company remains king of the global payments industry. The company has virtually no competition. Sure, Visa is often confused with Mastercard (MA). But Visa is the bigger fish in the payments pond. According to The Nilson Report, Visa accounts for 39% of all payment card transactions around the world compared to Mastercard’s 24% share of the market.

As such, Visa has been able to enjoy higher operating margins. The company’s trailing 12 month operating margin is 67%, much higher than Mastercard’s 58.6%. Visa is also highly profitable and going to continue sharing profits with investors through dividends, as it has since 2008. What I like even more is its payout ratio, which is currently 21.5%. That’s highly sustainable and I see the company gradually increasing it as it continues its dividend growth streak.

Additionally, Visa continues to grow. Over the last 10 years, the company’s net income has compounded at 13%. Analysts on Wall Street expect it to grow 12.6% over the coming five years. The bottom line is that V stock is a high quality compounder that’s going to continue to grow regardless of a bad headline or two. The government’s antitrust action is just a small pebble that the company can kick down the road.

Visa’s Wonderful Valuation

Not only does Visa have a great business, but it also has an attractive valuation, which makes me bullish on the stock. In fact, V stock is a wonderful business that’s available to investors at a fair price. The stock is currently trading at 24.75 times this year’s earnings while the S&P 500 index as a whole is trading at a forward price-to-earnings (P/E) ratio of of 23.65. Visa’s valuation is fair and attractive right now given its growth prospects, even as it trades at a slightly higher multiple than the overall market.

Analysts’ Take on Visa Stock

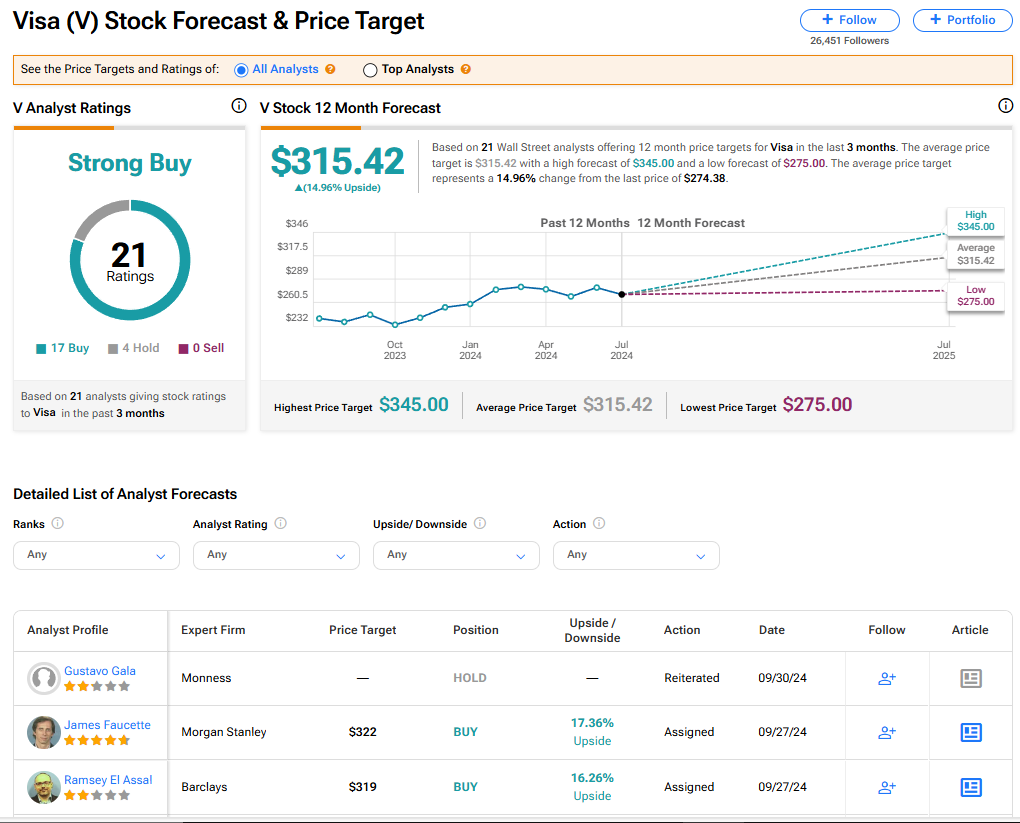

Visa stock currently has a consensus Strong Buy rating among 21 Wall Street analysts. That rating is based on 17 Buy and four Hold recommendations made in the last three months. There are no Sell ratings on the stock. The average price target on V stock of $315.42 implies upside potential of 14.96% from current levels.

Read more analyst ratings on V stock

The Bottom Line

Visa stock is a high quality compounder with a wide moat that’s incapable of being easily disrupted. There’s a lot of room for the stock to run further given its leading role in the digital payments space. I hunt for wonderful businesses at fair prices, and, with the recent selloff, Visa has just hit fair value territory. The company’s history of sharing profits with investors through dividends, and its compounding capabilities, outweigh any concerns over a government antitrust investigation. As such, I retain a very positive view of V stock.