Visa (V) and Mastercard (MA) have agreed to a settlement that could reshape how U.S. retailers accept credit cards. The payment giants are expected to cut fees and loosen long-standing rules after two decades of legal battles. The deal is subject to court approval.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The proposed deal, disclosed in a Brooklyn federal court filing, follows years of litigation in which merchants accused the companies of charging excessive “swipe fees” and violating antitrust laws.

The concerned fees typically range from 2% to 2.5% per transaction. They have long been a burden for businesses, raising operating costs and consumer prices. Retailers have long criticized swipe fees, which hit a record $187.2 billion last year, according to the Merchant Payments Coalition (MPC).

Merchants Gain More Control at Checkout

Under the new agreement, Visa and Mastercard will reduce average U.S. credit card interchange fees (paid by merchants when customers use credit cards) by 0.1 percentage points for five years. Also, standard U.S. consumer credit card rates will be capped at 1.25% until the deal expires.

One major change involves the “honor all cards” rule, which previously forced merchants to accept all Visa or Mastercard credit cards if they accepted any. This rule had become expensive as more shoppers used premium cards with higher fees.

Now, merchants can choose to accept cards in three categories: commercial, premium consumer, and standard consumer. This means some high-fee cards might be declined at checkout, while regular cards will still be accepted.

In addition, merchants will now be allowed to add surcharges for customers who use Visa or Mastercard, giving retailers more flexibility to pass costs to customers who pay with credit.

What It Means for Businesses and Consumers

For merchants, especially smaller ones, the fee reductions and added flexibility could translate into lower costs and better margins. For consumers, some may see more surcharges at checkout, while others could benefit from more competitive pricing if retailers pass savings along.

Visa called the settlement “meaningful relief” after more than 20 years of litigation, while Mastercard said it delivers “clarity, flexibility, and consumer protections.”

Which Stock Is Better, V or MA?

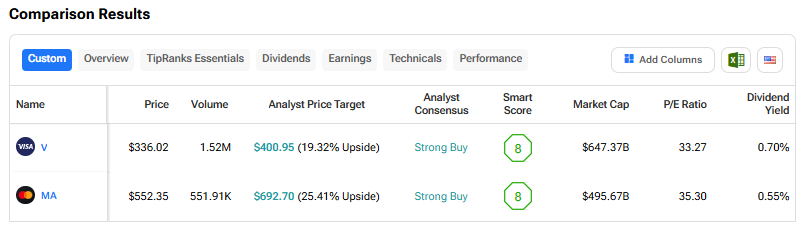

Turning to Wall Street, Visa and Mastercard stocks both have Strong Buy consensus ratings. Also, analysts see upside potential of 25.4% in MA stock and 19.3% in Visa stock.