Last fall, Aramark (NYSE:ARMK), a company specializing in food, facilities management, and uniforms, spun off its uniform services business and formed the independently traded company Vestis (NYSE:VSTS). Since then, the new company has gotten off to a rocky start, and its shares have fallen over 35% since it began trading on October 2, 2023.

Recent top and bottom-line quarterly misses have had Wall Street analysts revisiting expectations. Investors may want to stay on the sidelines until more positive results are reported.

Vestis Spin-Off

Previously known as Aramark Uniform Services, Vestis provides uniform rentals and workplace supplies to a broad spectrum of North American clients, from Fortune 500 firms to local small-scale enterprises across various end markets, serving over 300,000 locations. The company caters to diverse industries, from manufacturing and hospitality to pharmaceuticals and automotive, helping them reduce operating costs, enhance brand image, and maintain a safe and clean workplace.

Vestis operates in an industry estimated to be worth approximately $48 billion. So, there are ample opportunities for growth in this large, expanding, and highly fragmented market.

Analysis of Vestis’ Recent Financial Results

In the second quarter of 2024, the company’s revenue increased by 0.9% compared to the previous year, amounting to $705 million. However, revenue missed consensus expectations by $18.06 million. GAAP EPS of $0.05 also missed expectations by $0.13.

The company reduced its debt by $54 million in the second quarter, including a $45 million voluntary debt prepayment. This decreased net debt leverage from 3.95x at the end of fiscal 2023 to 3.82x at the end of Q2.

Management has revised its Fiscal 2024 revenue growth projections to (1)% and 0% and expects its adjusted EBITDA margin to range between 12.0% and 12.4%. The company has strategically moved to moderate pricing actions in the second quarter and the latter half of the fiscal year to improve retention as it enhances its service processes.

Even though this decision is projected to affect revenue and EBITDA negatively in the second half of the year, the company believes it is the right decision for the long-term growth and health of the business.

What Is the Price Target for VSTS Stock?

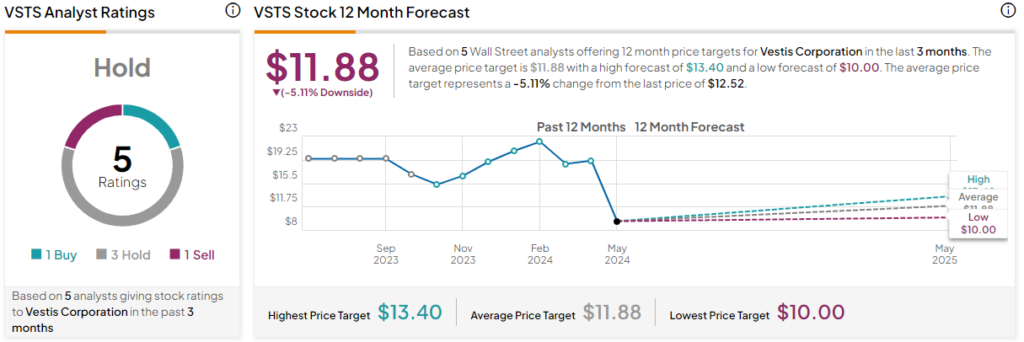

Analysts following the company have taken a cautious stance regarding the stock. Redburn Atlantic analyst Oliver Davies recently downgraded Vestis to Neutral with a $13.40 price target. He noted that business growth will likely remain negative into early next year.

Vestis is rated a Hold based on five Wall Street analysts’ recommendations and price targets over the past three months. The average price target for VSTS stock is $11.88, representing a -5.11% change from current levels.

The stock has been trending down, losing over 35% in the past 90 days. It sits at the lower end of its 52-week price range of $8.92-$22.33 and continues to show negative price momentum, trading below the 20-day (13.99) and 50-day (16.24) moving averages.

Summary

Vestis has experienced a challenging start after its spin-off. However, the company has demonstrated potential with a 0.9% revenue increase in Q2 2024 and active steps towards financial stability by reducing its debt. Yet the downward revision of fiscal 2024 projections suggests a cautious approach towards the company’s stock. Investors are advised to watch for more positive returns before committing to this stock.