Mobile provider Verizon (VZ) has not had a great run of things lately, and today only drove the point home a little harder. For folks with Verizon Fios internet, they lost service starting in the wee hours of Tuesday morning, and the outage went on for several hours. Now, however, service appears to be restored in many places, but the damage was done, and Verizon shares were down fractionally in Tuesday afternoon’s trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

A Newsweek report noted that the outage area ran for about 300 miles along the East Coast of the United States, with outages from Pennsylvania to Virginia. There was also a section of Kansas that seemed to be hit, though it was unclear if the two were related. Verizon reps, meanwhile, offered up an emailed statement to Newsweek, declaring, “A network issue early this morning disrupted service for some Verizon Fios customers in the northeast a short period of time. As soon as the issue was identified, our engineering teams quickly restored the service.”

The biggest part of the outage, the report noted, ran between midnight and 2:00 a.m. Eastern Time, as “thousands” of complaints hit. There were also several complaints about Verizon’s handling of the matter, which apparently included keeping customers in the dark about when service would be back on.

Disaster Planning

Verizon has more on its plate right now than just outages; it recently sent the Verizon Frontline Crisis Response Team to work in a “Nuclear Hostile Action Exercise” in Brunswick County, North Carolina, which apparently was spared much of the devastation from Hurricane Helene. Verizon’s team backed up communications efforts for the exercise, offering, among other things, a Satellite Picocell on a Trailer, Voice over IP (VoIP) devices, and more.

Is Verizon Stock a Good Buy Right Now?

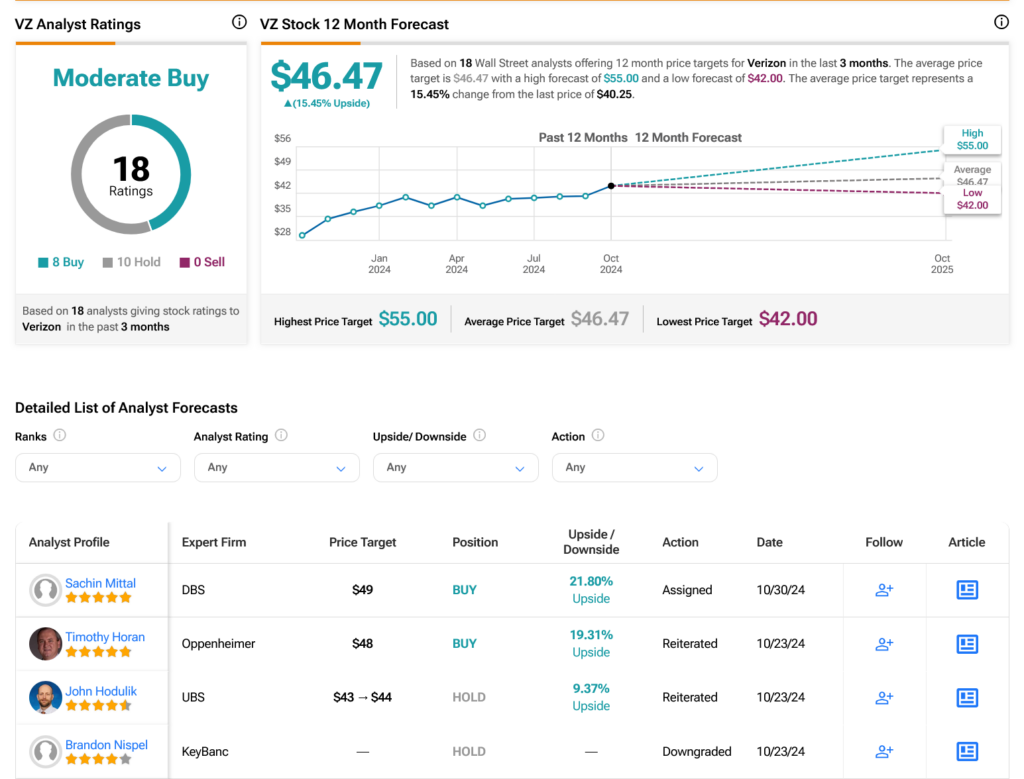

Turning to Wall Street, analysts have a Moderate Buy consensus rating on VZ stock based on eight Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 17.94% rally in its share price over the past year, the average VZ price target of $46.47 per share implies 15.45% upside potential.