Verizon Communications (VZ) is known not only for providing reliable network solutions and services but also for its consistent dividend payouts. Importantly, the company has increased its dividend for 19 consecutive years and has a dividend yield of 6.39%, much above the communication services sector’s average of 2.5%.

It is noteworthy that Verizon carries a “Perfect 10” Smart Score on TipRanks. Historically, stocks with the “Perfect 10” score have outperformed the S&P 500 Index (SPX) by a wide margin.

Let’s take a closer look at the stock.

Here’s What Makes Verizon Stock Worth Considering

The company’s consistent dividend growth makes it a favorite among income-oriented investors. The high dividend yield, coupled with stable cash flows, provides a reliable income stream. Also, efficient cost control measures support bottom-line expansion.

Verizon has been investing heavily in its 5G network, aiming to maintain its leadership position. It should be noted that successful 5G deployment can support revenue growth and customer acquisition. Furthermore, the company’s focus on fiber-optic networks should boost its long-term growth prospects.

According to the TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” bullish analysts view Verizon as a compelling investment due to its successful customer acquisition, robust 5G network expansion, and growing fixed broadband services.

What Is the Prediction for Verizon Stock?

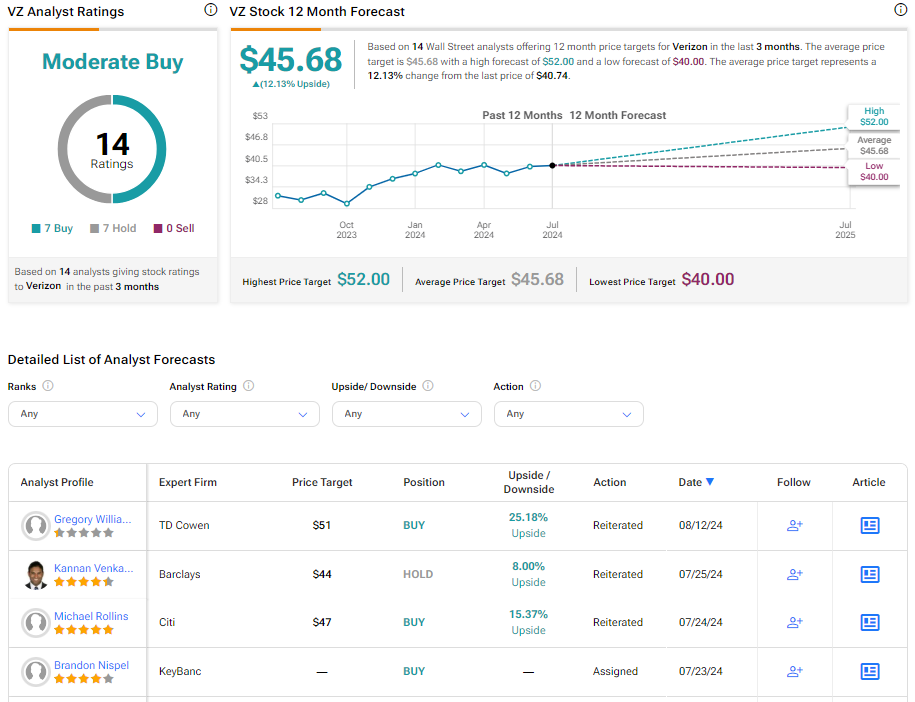

Overall, Wall Street is cautiously optimistic about the stock. VZ has a Moderate Buy consensus rating based on seven Buys and seven Holds. The analysts’ average price target on VZ stock of $45.68 implies an impressive 12.13% upside potential from current levels. Shares of the company have gained 13.48% year-to-date.