VEREIT (VER) has announced that as of September 22, 2020, it has received rent of approximately 87% for the second quarter, compared to 86% previously reported.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

This is made up of 92% recent received for July, 94% for August, and 95% for September- and includes approximately 2% to be paid in arrears by a Government agency tenant.

The REIT also stated that it expects to issue its Third Quarter 2020 Quarterly Report on Form 10-Q on Thursday, November 5, 2020.

VEREIT, a full-service real estate operating company which owns and manages one of the largest portfolios of single-tenant commercial properties in the US, has seen shares plunge by 30% year-to-date.

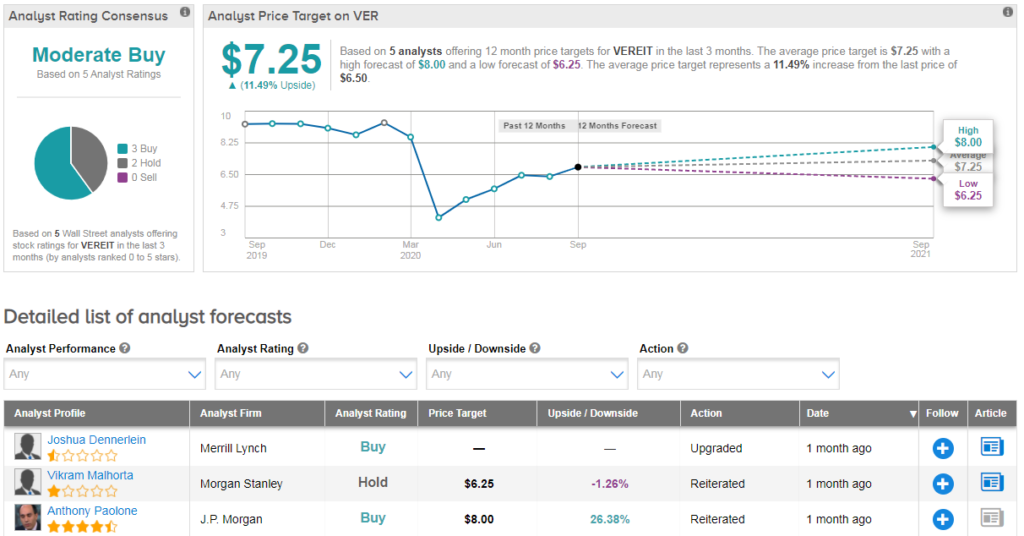

However, the Street has a cautiously optimistic Moderate Buy consensus on the stock. Out of 5 analysts polled in the last 3 months, 3 are bullish on the stock, while 2 remain sidelined. With an 11% upside potential, the stock’s consensus target price stands at $7.25.

Speaking for the bulls, JP Morgan’s Anthony Paolone sees the company’s successful rent collection during the coronavirus crisis as an important strength for the stock.

“[Its] collections showed good improvement going into July, with 85% collections in 2Q and 91% in July; when considering all the abatements and deferrals, it appears that at this point about 94% of pre-COVID contractual rental revenue has been addressed, and it seems to us that a normalized run rate for this vast majority of the portfolio should take hold in early 2021; the company is making progress in working through the remaining 5-6% of non-collections,” Paolone noted recently.

His $8 price target implies a 23% upside for the next 12 months.

Meanwhile Board member and CEO Glenn Rufrano has just spent over $252K on a block of 40,000 VER shares, pushing the insider sentiment on this stock into positive territory. (See VEREIT’s stock analysis at TipRanks)

Related News:

Caesars Rolls Out Share Sale Amid $3.7B William Hill Bid

Tapestry vs Capri: Which Luxury Stock Has A Better Chance of Recovery?

Tesla Signs Deal To Procure Ore From Australia’s Piedmont