In an era where high-yield savings accounts and Treasury bonds offer increasingly competitive returns, dividend stocks might seem less appealing at first glance. However, savvy investors know that undervalued dividend stocks can offer both steady income and the potential for capital appreciation. Two such stocks that have caught the attention of market analysts are United Parcel Service (UPS) and Ford Motor Company (F).

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

While many stocks with attractive yields come with hidden risks or unsustainable payouts, UPS and Ford offer a compelling combination of undervalued share prices, strong business fundamentals, and consistent dividends.

Let’s look at these companies to understand why they’ve earned a spot on my watchlist of undervalued dividend stocks. I am bullish on both UPS and F.

United Parcel Service (NYSE:UPS)

When it comes to major players in logistics, United Parcel Service immediately comes to mind. This company, known for its brown uniforms, has been successfully delivering packages and generating profits for decades.

The company offers a 4.57% yield and a quarterly dividend of $1.63 per share. That’s nothing to sneeze at in today’s market, especially when this isn’t some fly-by-night operation but a company with a history of delivering for its shareholders. The company has raised its dividend for 14 consecutive years.

In the first quarter of 2024, UPS reported consolidated revenues of $21.7 billion, a 5.3% decrease from last year. The company’s U.S. Domestic segment saw a 5.0% revenue decline, driven by a 3.2% decrease in average daily volume.

The stock market’s reaction to UPS’s first-quarter earnings was mixed. While the company surpassed profit expectations, it fell short of revenue targets. UPS shares initially rose by as much as 3% in premarket trading following the earnings report but subsequently reversed course and were trading about 1% lower an hour before the opening bell

However, UPS’s strategic initiatives, outlined in its “Customer First, People Led, Innovation Driven” approach, aim to position the company as a premium small package provider and logistics partner worldwide. This approach sounds like a mouthful, but it basically means they’re focusing on what they do best while trying to do it even better.

UPS is currently trading at about 18 times 2024 earnings, which is lower than the industry average of 20x in Q1 2024. This further supports the notion that UPS is trading at a relative discount to the broader industry, even though its P/E is slightly higher than that of direct competitors.

Analysts expect UPS to report earnings of $1.99 per share for the quarter ending June 2024, representing a 21.7% year-over-year decline. Nevertheless, revenues are expected to increase by 1.4% to $22.36 billion.

Further, the company has set ambitious financial targets for 2026, including consolidated revenue ranging from $108 billion to $114 billion and a consolidated adjusted operating margin above 13%. These targets reflect UPS’s commitment to growth and efficiency improvements.

Is UPS Stock a Buy, According to Analysts?

According to the latest analyst ratings, UPS stock has a Moderate Buy consensus rating. Out of 18 analysts covering the stock, nine rate it a Buy, eight a Hold, and one a Sell. The average UPS stock price target of $159.17 implies upside potential of around 10.5%.

Ford Motor Company (NYSE:F)

Ford Motor Company, an iconic American automaker, has been a cornerstone of the automotive industry for over a century. Known for its diverse vehicle lineup, Ford has recently been focusing on electrification and commercial vehicles.

Ford’s commitment to shareholder returns is evident in its dividend policy. Ford continues to offer a compelling dividend yield of approximately 5.56%, reflecting its regular and special dividends. Additionally, it has paid dividends every year for 13 years, with a payout ratio of 41.27%, demonstrating its dedication to returning value to shareholders.

Ford recently announced that it’s cutting back on electric vehicle (EV) production. You might think this would be a negative for the company, but the market seems to disagree. Ford’s shares jumped 2.5% on the news, now up 19% year-to-date.

This recent rally has outpaced the broader market and some of its competitors, such as General Motors (GM). From a valuation perspective, the $57.8 billion market cap stock trades at a forward P/E ratio of 6.9x, indicating that the market expects Ford’s earnings to improve soon. Compared to its peers, Ford’s valuation metrics suggest it might be undervalued.

Ford’s forward P/E ratio is substantially lower than Tesla’s (TSLA) 93.8x, positioning it as a potentially more attractive option for value investors. While it’s a bit higher than General Motors’ (GM) 5x, Ford still appears competitively priced within the automotive industry.

Despite this pullback in EV production, Ford remains committed to its electrification strategy. The company still plans to offer a full lineup of EVs alongside its traditional internal combustion engine and hybrid vehicles. This balanced approach could prove advantageous, allowing Ford to cater to different consumer preferences while the EV market continues to evolve.

Is F Stock a Buy, According to Analysts?

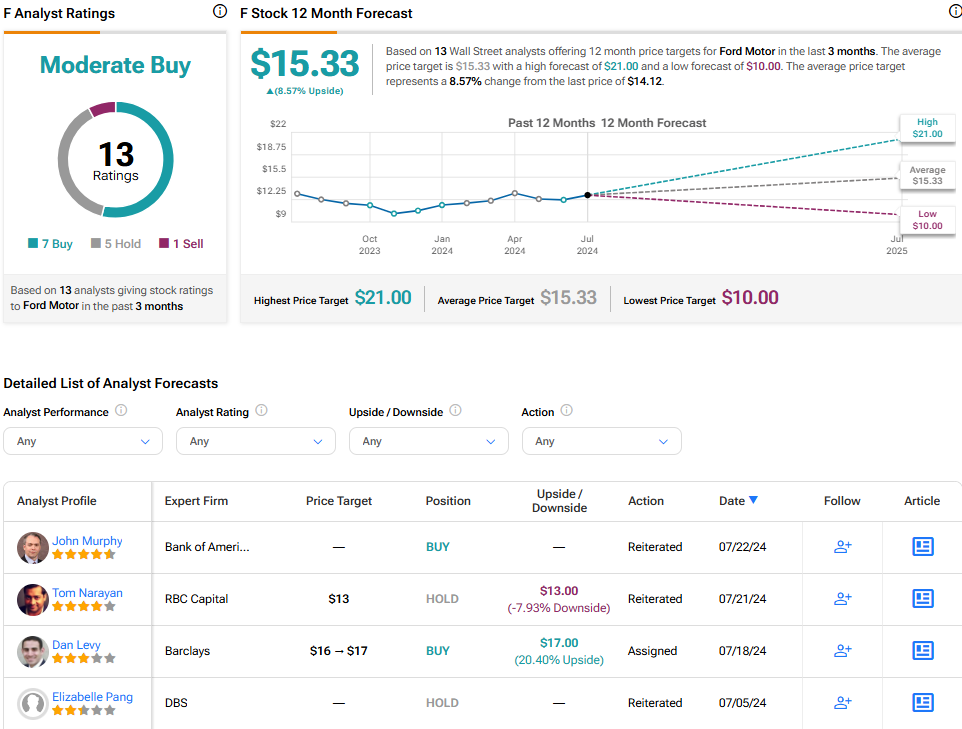

According to the latest analyst ratings, Ford stock has a Moderate Buy consensus rating. Out of 13 analysts covering the stock, seven rate it a Buy, five a Hold, and one a Sell. The average Ford stock price target of $15.33 implies upside potential of 8.6%.

See more F stock analyst ratings

The Bottom Line

UPS and Ford present compelling cases as undervalued dividend stocks in today’s market. UPS, with its dominant position in logistics and e-commerce, offers stability and a solid 4.57% dividend yield despite facing short-term challenges. On the other hand, Ford provides a higher-risk, higher-reward proposition with its 5.56% dividend yield and aggressive push into electric and hybrid vehicles.

While both companies have unique challenges, their attractive valuations and strategic initiatives make them worthy contenders for income-focused investors willing to weather some market volatility.