Legacy automaker Ford (F) has been pushing the “No Boring Cars” concept, like we found out yesterday, but while it tries so hard to avoid boring, has it forgotten to advance wins anywhere else? New reports say there is trouble on the electric and the gas-powered front alike. But investors are rallying, and Ford shares were up modestly in Friday afternoon’s trading.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The first bit of bad news came from Rivian (RIVN), noted a report from Inside EVs. The report in question pointed out that Rivian’s van, the Commercial Van, actually managed to outsell both the Ford E-Transit electric van and the Mercedes-Benz (MBGAF) eSprinter. Worse, Rivian actually outsold the both of them combined.

Adding insult to injury was the revelation that General Motors’ (GM) BrightDrop van came in in third place, though it was a pretty distant third at that. The report noted that Rivian sold 13,423 Commercial Van models, while Ford brought in just 12,610. GM, meanwhile, could only sell 1,529, while Mercedes-Benz sold almost a tenth of that at 191.

But the Pickups Are…Nothing Great, Apparently.

This by itself may not be such a problem, as Ford still has a thriving market for gas-powered vehicles. Well, not so much, noted a report from Torque News, who featured someone taking a look at a Ford F-150 Platinum. The result was actually rather distressing, especially for anyone who follows or invests in Ford.

The potential buyer revealed that he was considering an F-150 Platinum, with the heart-stopping price tag of about $85,000. The buyer in question also noted that the F-150 Platinum had stepped down from a V8 to a V6 hybrid, with two separate coolant reservoirs and a construction that seemed to be mostly “plastic.” And that, coupled with several other factors, got that buyer looking to Stellantis (STLA) and its Dodge Ram instead. That is terrible news for Ford.

Is Ford Stock a Good Buy Right Now?

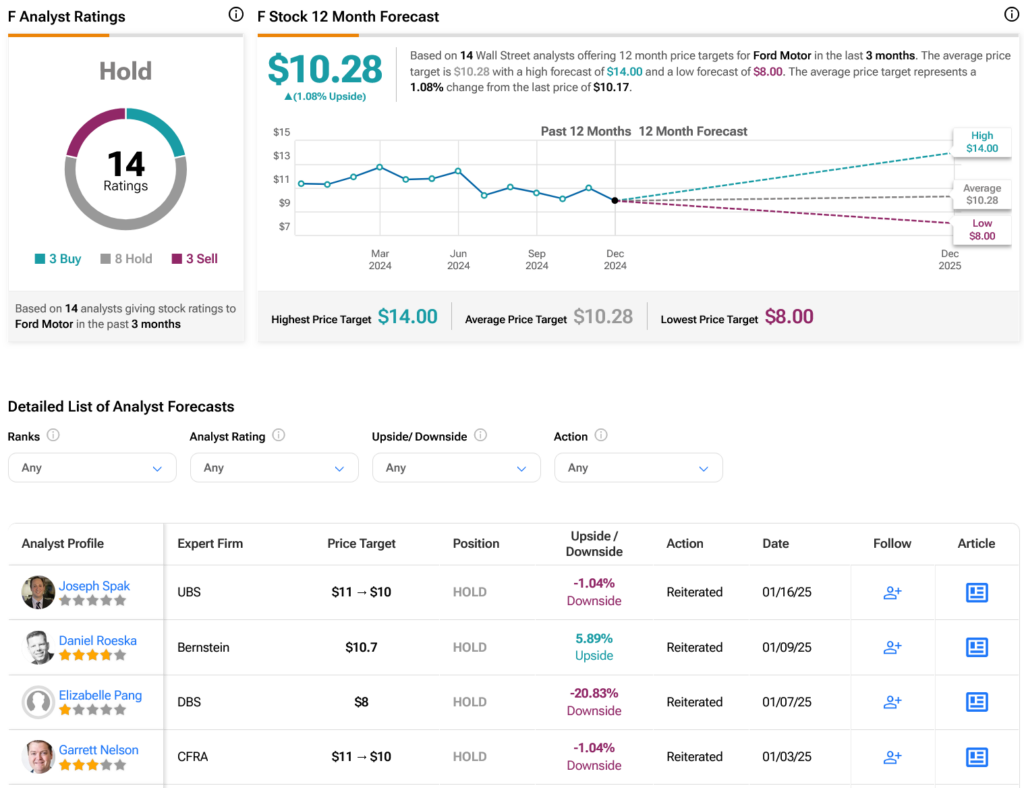

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on three Buys, eight Holds and three Sells assigned in the past three months, as indicated by the graphic below. After a 1.61% loss in its share price over the past year, the average F price target of $10.28 per share implies 1.08% upside potential.