Alibaba’s (BABA) stock has soared by 33% year-to-date, riding a wave that has boosted many Chinese equities due to favorable economic stimulus from the Chinese government. Beijing has recently rolled out measures to boost economic activity and stabilize financial markets, including tax incentives for small businesses and a reduction in key interest rates. While many fear that the recent euphoria may end up short-lived, I believe Alibaba stock could still have a notable upside.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Two catalysts shine brighter than most: The potential for re-accelerating growth powered by cloud, particularly AI-driven revenues, and the stock’s valuation remains attractive. Thus, I am bullish on BABA stock.

Cloud Revenues To Re-Accelerate Growth

The primary catalyst that can power further gains in Alibaba stock is the potential for its cloud revenues to reignite growth. In its latest Q1 2025 results, Alibaba Cloud revenues increased by 6% year-over-year, reaching RMB 26.5 billion ($3.65 billion), picking up from last year’s growth of 4%. This result was mainly driven by public cloud services, which recorded double-digit growth. This, in turn, was driven mainly by strong demand for cloud computing and digital transformation solutions across various industries and sectors like e-commerce, finance, and logistics.

BABA’s management emphasized the high-quality nature of cloud revenues. It has shifted focus from low-margin project-based revenues to scalable public cloud products, improving the segment’s profitability. Also, Alibaba Cloud’s expanding client base and massive infrastructure position it to capture more market share as companies migrate to cloud-based solutions. Alibaba is, therefore, confident that cloud revenues will return to double-digit growth in the second half of Fiscal 2025, indicating the possibility of accelerating revenues ahead.

AI-Driven Revenues To Play Critical Role

AI-driven revenues, in particular, seem set to play a critical role in accelerating Alibaba’s cloud and overall revenue growth. In the most recent post-earnings call, management said that AI-related product revenue increased at a triple-digit rate, highlighting the rapid adoption of AI tools and services. In line with what we have witnessed in the North American market in recent quarters, this demand surge is powered by businesses looking to enhance their day-to-day operations via automation, data analytics, and machine learning capabilities.

Looking ahead, Alibaba appears to be aggressively investing in AI infrastructure and research to enrich its offerings. Given the ongoing growth in AI-related demand, management expects AI services to be one of the most significant drivers of accelerated cloud adoption and consequently, overall revenue growth in the coming quarters.

Alibaba’s Valuation Remains Attractive

Another factor that makes me bullish on the stock despite its already prolonged rally is that Alibaba looks attractively priced compared to peers today, offering significant upside potential. Its price-to-free-cash-flow (P/FCF) ratio stands at just 11.3 times based on this year’s consensus free cash flow estimate of $22.0 billion and 10.3 times based on next year’s projected free cash flow of $24.1 billion. Clearly, Alibaba trades at a significant discount to most global tech giants, even if its comparative growth is indeed reasonably subpar.

Further supporting Alibaba’s investment case at its current valuation is the company’s aggressive share buyback program. Over the past 12 months, the company has repurchased $18.1 billion worth of its stock, translating to a buyback yield of 7.9% even at its current elevated price levels. Not only does such a high level of buybacks demonstrate management’s confidence in Alibaba’s long-term value, but it should also directly boost its earnings per share in the coming quarters.

In addition to buybacks, Alibaba’s strong profitability supports growing dividend payments, which, when combined with the buybacks, offer investors a 9% blended yield, again, even after the stock’s extended rally.

Is BABA Stock a Buy, According to Analysts?

Looking at Wall Street’s view on BABA stock, we see a Strong Buy consensus rating based on 16 Buys and three Holds assigned in the past three months. This is noteworthy given the recent share price gains and matches my view of the potential for further gains. At $123.74, the average BABA stock forecast suggests a 20.80% upside potential.

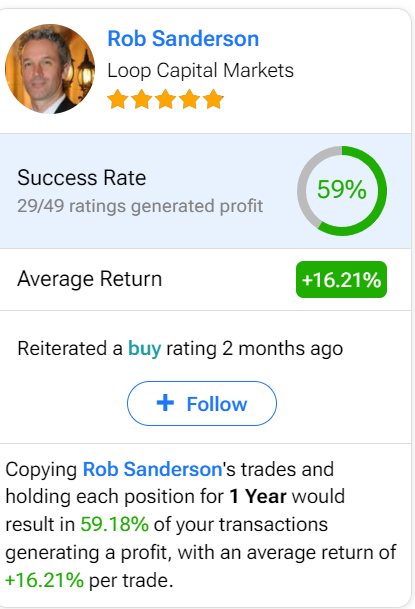

If you’re pondering which analyst to trust for trading BABA stock, consider Rob Sanderson from Loop Capital Markets. According to Tipranks’ ratings, he is a five-star analyst. Over the past year, he has been the most accurate and most profitable analyst covering this stock, delivering an average return of 16.21% per rating with a 59% success rate. Click on the image below to learn more.

Takeaway

I believe that Alibaba’s stock shows notable potential for additional upside despite its year-to-date gains. Key growth drivers include the re-acceleration of cloud revenues, supported by rising demand for cloud and AI-related services, and the stock’s relatively attractive valuation.

In particular, by focusing on high-margin, scalable products and aggressive investments in AI, Alibaba is well-positioned to capitalize on growing digital transformation trends. Moreover, its increasing capital returns highlight its relative undervaluation. Therefore, I believe that Alibaba’s investment case remains compelling as we gear up for its Fiscal Q2 2025.