Unity Software (U) recently reported earnings for its second quarter of Fiscal Year 2022. Adjusted earnings per share came in at -$0.18, which beat analysts’ consensus estimate of -$0.21. In the past nine quarters, the company has met or beat estimates each time. Nevertheless, shares are slightly down in after-hours trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In addition, sales increased 9% year-over-year, with revenue hitting $297 million compared to $273.6 million. The revenue increase was primarily driven by an increase in customers that generated over $100,000 in revenue. In the last 12 months, 1,085 customers met this benchmark compared to 888 in Q2 2021.

However, gross profit decreased by 7.2%, which means that the company did not demonstrate any operating leverage. Indeed, the gross margin contracted from 78.9% to 67.4%. This, along with an increase in operating expenses, caused the company’s operating loss to increase dramatically from $149.2 million in the comparable period to $197.7 million now.

AppLovin Offers to Acquire Unity Software for $17B

AppLovin Corp (APP) announced on Tuesday that it had made an offer to acquire Unity Software. The offer is comprised of an all-stock deal worth $17.54 billion, which equates to $58.85 per each share of Unity. This might be a good combination if management’s projections are correct. Indeed, APP’s CEO claims that the combined company could produce $3 billion in adjusted operating profit by the end of 2024.

This comes after Unity made an offer to acquire ironSource (IS) for $4.4 billion. As part of the AppLovin deal, Unity would have to terminate the ironSource transaction.

What’s interesting about the proposal is that both companies are similar in size, although Unity now has a larger market cap as AppLovin’s stock declined 10% following the announcement. It’ll be interesting to see if this deal goes through as it will create a lot of dilution for existing APP shareholders.

Is Unity Software Stock a Buy, Sell, or Hold?

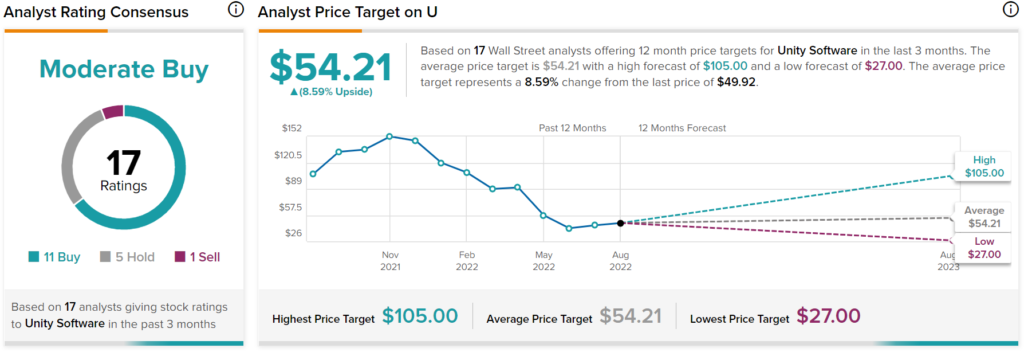

Unity Software has a Moderate Buy consensus rating based on 11 Buys, five Holds, and one Sell assigned in the past three months. The average Unity Software price target of $54.21 implies 8.6% upside potential.

Final Thoughts – Unity Software Had an Underwhelming Quarter

Unity saw decent growth in the quarter, as revenue increased by 9% while adjusted earnings came in better than expected. However, the contracting margins and the widening losses are not what investors want to see, especially in the current market environment. As a result, the share price fell slightly after the announcement.