Following disruptions caused by the pandemic to the travel industry, a booming demand in the sector became predictable from the pent-up demand and waning COVID-19 restrictions. Companies are striving hard to achieve profits despite the negative impacts from macroeconomic factors, such as inflationary pressures, rising input and wage costs, and Russia’s war on Ukraine which led to skyrocketing oil prices.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

United Airlines Holdings, Inc. (NASDAQ: UAL) is one such airline company that foresees a rise in travel demand which will aid revenues in the coming period. Though the company has reduced capacity, it has lifted revenue expectations for the second quarter.

Following the update, shares of the company rose 3.3% in the extended trading session on Monday.

Current Expectations

Total revenue per available seat mile is now expected to be up 23%-25% from the same period in 2019, up from the prior expectations of 17%. Holiday season traffic, re-opening of offices, and easing restrictions on cross-border travel are expected to aid a rise in travel bookings.

Additionally, strong consumer demand is helping carriers to combat elevated fuel costs, which rose significantly over the past year.

However, these hikes in cost have yet to stabilize, as United Airlines forecast fuel cost to escalate by 17% in Q2, and by approximately 40% on a sequential basis. Also, capacity is likely to decline 14% from pre-pandemic levels, compared with the prior forecast of 13%.

Though non-fuel operating expenses is also estimated to trend higher, an adjusted operating margin of 10% is expected.

Analysts Recommendation

Recently, Wolfe Research analyst Scott Group upgraded United Airlines to a Hold from a Sell but did not assign a price target.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 10 Buys, seven Holds, and one Sell. The average United Airlines price target of $59.85 implies 37.46% upside potential. Shares have declined 23% over the past year.

Bloggers Weigh In

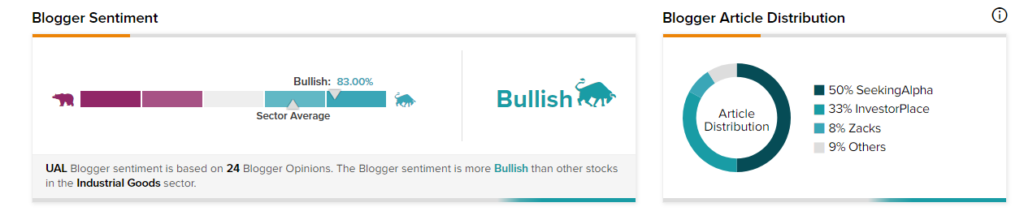

Bloggers seem enthused by the company’s developments. TipRanks data shows that financial blogger opinions are 83% Bullish on UAL, compared to a sector average of 69%.

Bottom-Line

With high analyst ratings, a strong outlook, and stock price performance as factors in consideration, investors might cautiously invest in this stock.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Moderna’s New CFO Departs on Legal Issues

Large Layoffs at Alibaba-Russia Joint Venture

Eli Lilly’s Mounjaro Injection Bags FDA Approval