Teladoc (TDOC) is an American virtual healthcare company. It provides telehealth solutions, expert medical opinion, medical devices, artificial intelligence, and analytics.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Q4 2021, Teladoc reported a 45% year-over-year jump in revenue to $554.2 million, beating the consensus estimate of $546.6 million. It posted a loss per share of $0.07, which narrowed from a loss per share of $3.07 in the same quarter the previous year and beat the consensus estimate of a $0.56 loss per share. The company ended the quarter with $893.5 million in cash.

Teladoc anticipates Q1 2022 revenue to be in the range of $565 million to $571 million. It expects a loss per share in the band of $0.60 to $0.50.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Teladoc.

Risk Factors

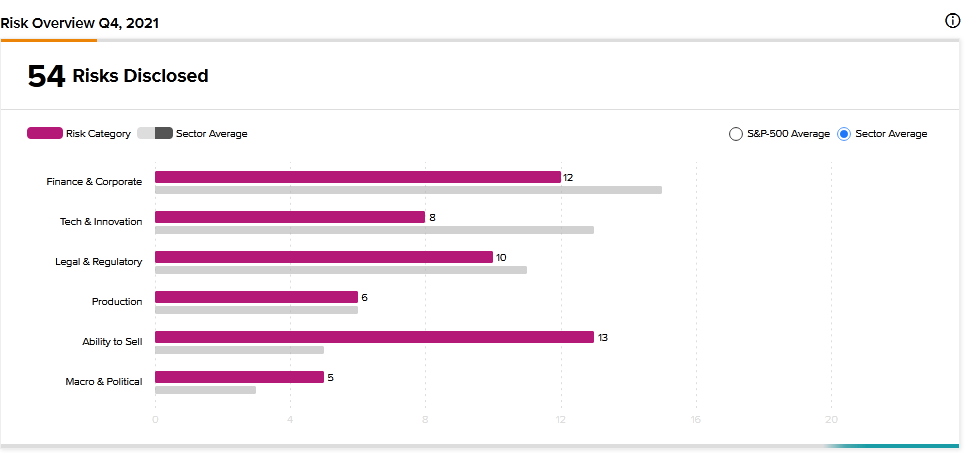

According to the new TipRanks Risk Factors tool, Teladoc’s main risk category is Ability to Sell, with 13 of the total 54 risks identified for the stock. Finance and Corporate and Legal and Regulatory are the next two major risk categories with 12 and 10 risks, respectively.

In a newly added Finance and Corporate risk factor, Teladoc cautions that it may incur non-cash impairment charges on its goodwill and that such charges would adversely affect its operating results. Goodwill was valued at $14.5 billion at the end of 2021. Teladoc subjects its goodwill to impairment tests when certain events occur, such as a sustained decrease in its stock price.

Teladoc tells investors in a newly added Legal and Regulatory risk factor that it could be subject to securities class action lawsuits. It explains that when a company’s stock price declines, it could face class action litigation. It says that it has been subject to such lawsuits in the past and may be affected by similar lawsuits in the future. Teladoc warns that such litigation could result in significant costs and divert the management team’s attention and resources. As a result, the company’s business, financial condition, and operating results could be harmed.

In another new Legal and Regulatory risk factor, Teladoc informs investors that changes in tax regulations may have a huge impact on its earnings and financial condition. It explains that its tax liability could be impacted by factors such as the effects of acquisitions and changes in non-deductible expenses.

Teladoc’s stock has declined 27% year-to-date.

Analysts’ Take

Berenberg Bank analyst Dev Weerasuriya recently maintained a Buy rating on Teladoc stock with a price target of $141, which implies 103.85% upside potential.

Consensus among analysts is a Moderate Buy based on 15 Buys and 9 Holds. The average Teladoc price target of $103.62 implies 49.80% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Broadcom’s Q1 Results Surpass Estimates; Street Says Buy

Making Sense of Wynn Resorts’ Risk Factors

Tesla Gets Environmental Approval for Gigafactory Outside Berlin — Report