Ulta Beauty (NASDAQ:ULTA) delivered better-than-expected Q1 financials. However, management lowered the Fiscal 2024 outlook during the Q1 conference call, citing moderating growth due to the tough year-over-year comparisons, primarily in the first half. Despite the guidance cut, ULTA stock jumped 5.6% in Thursday’s after-hours trading as its Q1 EPS beat lifted investors’ sentiment.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Adding to the positives, the specialty retailer of cosmetics, fragrance, skincare, and hair care products is focusing on strengthening its assortment, improving its digital experience, and offering an enhanced promotional and loyalty program. These initiatives are likely to accelerate its growth rate in the second half of the year. Moreover, comparisons are likely to ease in the latter half of 2024.

With this backdrop, let’s look at the company’s Q1 performance.

Ulta Beauty – Q1 Performance

Ulta Beauty’s net sales increased by 3.5% year-over-year to $2.73 billion in Q1, reflecting higher comparable sales. Moreover, it benefitted from new store openings. Its sales came slightly higher than the analysts’ estimate of $2.72 billion.

The company’s gross margin decreased by 80 basis points, reflecting lower merchandise margins and a higher inventory shrink.

Ulta Beauty delivered earnings of $6.47 per share, down about 6% year-over-year. However, its EPS exceeded the Street’s forecast of $6.25 per share.

Outlook Lowered

The company lowered its sales outlook for Fiscal 2024. It now expects sales to be $11.5 billion to $11.6 billion, down from the previous forecast of $11.7 billion to $11.8 billion.

Ulta Beauty expects its comparable sales to increase by 2-3% in Fiscal 2024, down from its earlier forecast of 4-5% growth. Moreover, the operating margin is now likely to be between 13.7% and 14%, down from the previous outlook of 14-14.3%.

EPS is expected to be $25.20 to $26 in Fiscal 2024, down from $26.20 to $27.

Is Ulta Beauty Stock a Buy?

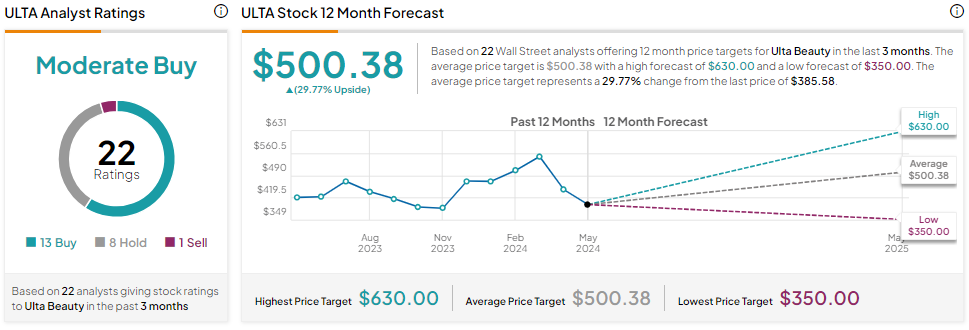

Ulta Beauty stock is down over 21% year-to-date. Further, Wall Street is cautiously optimistic about its prospects. It has 13 Buys, eight Holds, and one Sell recommendation for a Moderate Buy consensus rating.

The analysts’ average price target for ULTA stock is $500.38, implying a 29.77% upside potential from current levels.