Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) has made significant moves recently in its portfolio, reflecting a dynamic strategy in response to market conditions. In the latest transactions, Berkshire increased its stake in several companies while reducing its holdings in others. The question arises: What does Berkshire see that others don’t, and is it signaling a shift in the hedge fund’s investing strategy? First, let’s examine the recent movements and then deduce their meaning.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Increased Stakes, Reduced Stakes

In recent strategic moves, Berkshire Hathaway significantly boosted its stake in Occidental Petroleum (OXY) to over 28% by purchasing an additional 763,000 shares on February 7, 2025, bringing its total investment to $12.9 billion. Additionally, Berkshire acquired in the fourth quarter of 2024, 5.6 million shares of Constellation Brands (STZ), a beer and wine producer valued at over $1 billion. Berkshire also nearly doubled its holdings in Domino’s Pizza (DPZ) to 2.4 million shares during the same period. The company also increased its stake in Pool Corporation (POOL), a seller of swimming pool supplies. It boosted its stake in Heico Corporation (HEI), an industrial components maker, which saw a 51% rise in stock value in 2024.

Conversely, Berkshire Hathaway reduced its positions in several other companies. In the fourth quarter of 2024, the conglomerate reduced its stake in Bank of America (BAC) by 15% to 680 million shares and decreased its holdings in Citigroup (C) by approximately 75% to 14.6 million. Berkshire also trimmed its stake in Apple (AAPL) by 25%, selling 100 million shares during the same period. Additionally, the company sold its shares in Ulta Beauty (ULTA), leading to a 0.9% drop in Ulta’s stock post-sale.

Does it Reflect a Shift in Strategy?

Berkshire’s latest moves show they’re shifting towards sectors they think will grow and stay stable. Its buying more shares in companies like Occidental Petroleum and Constellation Brands, which means its betting on industries with strong demand and solid business models. Investing in Domino’s Pizza shows the belief in the growing fast-food sector thanks to high consumer demand and new delivery methods.

On the flip side, the hedge fund is cutting back on shares in Bank of America and Citigroup, which suggests it’s being cautious about the banking sector, possibly due to regulatory issues and market ups and downs. Even though Apple is doing well, Berkshire might sell some shares to lock in profits and invest elsewhere.

These changes show Berkshire’s flexible investment approach, balancing risk and reward in a constantly changing market. Investors are watching closely to see what Berkshire does next as it continues to shape its portfolio for future growth. But does this mean Berkshire is changing its strategy, moving away from banking and tech and focusing more on energy, industrial, and food sectors?

All these companies have strong demand and resilient business models, which fit with Berkshire’s focus on long-term stability and growth. So, it’s not really a big shift, just a bit of a rearrangement.

Is Berkshire Hathaway a Good Stock to Buy?

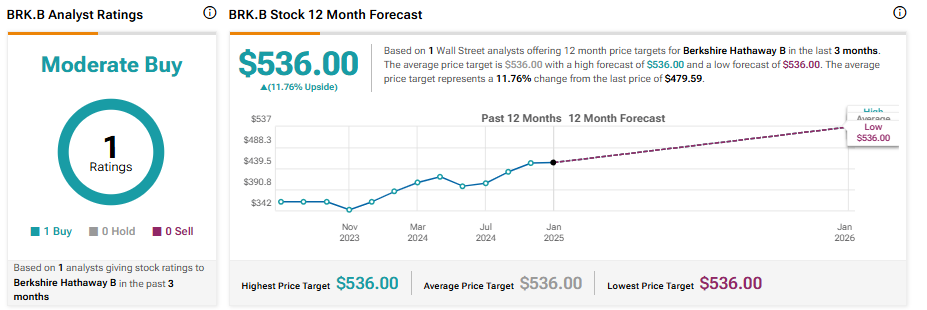

Turning to Wall Street, Berkshire Hathaway is considered a Moderate Buy. The average price target for BRK.A stock is $803.444, implying an 11.72% upside potential. The average price target for BRK.B is $536, indicating an 11.76% upside potential.