Shares of FTSE 100-listed Rolls-Royce Holdings PLC (GB:RR) soared to an all-time high, as the company announced the return of dividends after its last payout in 2020. The company stated that it would begin with a payout ratio of 30% of the underlying profit after tax. Rolls-Royce also raised its full-year guidance for underlying operating profit to the range of £2.1 billion to £2.3 billion, up from the previous forecast of £1.7 billion to £2.0 billion. RR shares gained over 10% as of writing.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company also raised its free cash flow guidance to the range of £2.1 billion to £2.2 billion from £1.7 billion to £1.9 billion.

Year-to-date, the stock has continued its favourable momentum with a gain of 64%. In 2023, Rolls-Royce’s stock soared over 190%, making it the best performer on the FTSE 100 index.

Rolls-Royce’s First-Half Performance

In the first half, Rolls-Royce’s revenues increased by 18% year-over-year to £8.2 billion. At the same time, the company’s underlying operating profit jumped 74% to £1.15 billion compared to the first half of 2023.

Overall, the first half results benefitted from improved cost discipline, higher demand for large jet turbines and the company’s turnaround efforts.

Among Rolls-Royce’s segments, the Civil Aerospace division achieved an operating margin of 18.0% in H1 2024, up from 12.4% in the comparable period of the previous year. This growth was primarily due to increased aftermarket profits from LTSA (large engine long-term service agreements), enhanced performance in the business aviation sector, and improvements in contractual margins. As a result, Rolls-Royce’s operating margin increased by 4.4 percentage points to 14% in the first half.

In terms of outlook, the company maintained a cautious tone due to supply chain challenges and expects them to continue for 18-24 months.

Is Rolls-Royce Stock a Good Buy?

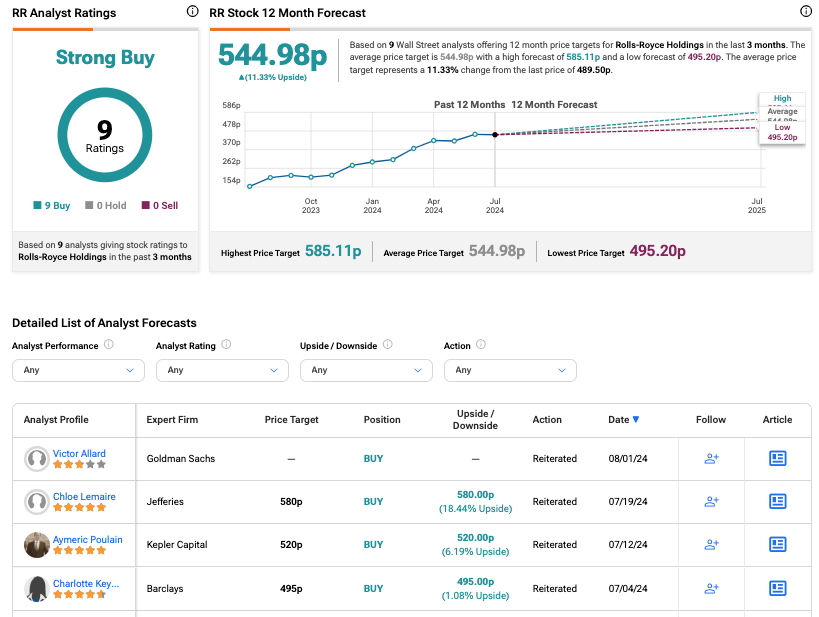

Following the results, analyst Victor Allard from Goldman Sachs confirmed a Buy rating on RR stock, driven by a strong set of results. Allard believes that the results will lead to low-double-digit upgrades to consensus and will also drive the share price higher.

According to TipRanks, RR stock has received a Strong Buy rating based on all Buy recommendations from nine analysts. The Rolls-Royce share price forecast is 544.98p, which is 11.3% higher than the current trading level.