Shares of the UK-based Marshalls PLC (GB:MSLH) dropped by 1.12% as of writing after the company reported a decline in its revenue and profit for the first half of 2024. The company’s H1 FY24 adjusted pre-tax profit decreased by 20% to £26.6 million, with revenue falling 13% year-over-year to £306.7 million.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Marshalls is a manufacturing company that specialises in building, roofing, and hard landscaping products.

Marshalls’ Landscape Products Unit Weighs on H1 Results

Marshalls’ H1 performance was mainly hit by the weakness in its Landscape Products division. The company’s Landscape Products unit generates 45% of its revenues from infrastructure and commercial activities, 30% from newly built housing, and 25% from repair, maintenance, and improvement (RMI). In the first half, the company witnessed low levels of new construction and reduced spending on private housing RMI.

On the brighter side, Marshalls reduced its net debt by £28.8 million to £155.8 million in H1, maintaining a strong balance sheet. The company also benefited from effective cost control and working capital management. As a result, its adjusted operating cash flow conversion was robust, reaching 111% (on an annualized basis for the period ended June 30, 2024) of adjusted EBITDA.

The company maintained its interim dividend at 2.6p per share, similar to last year’s payment.

Moving forward, Marshalls expects a modest market recovery and plans to introduce a new five-year strategy in November 2024, focused on medium-term growth. The company is identifying opportunities to use its diverse portfolio to generate more value. Marshalls’ strategic plan includes expanding beyond its core Landscape and roofing sectors into promising markets such as bricks and masonry, water management, and energy transition.

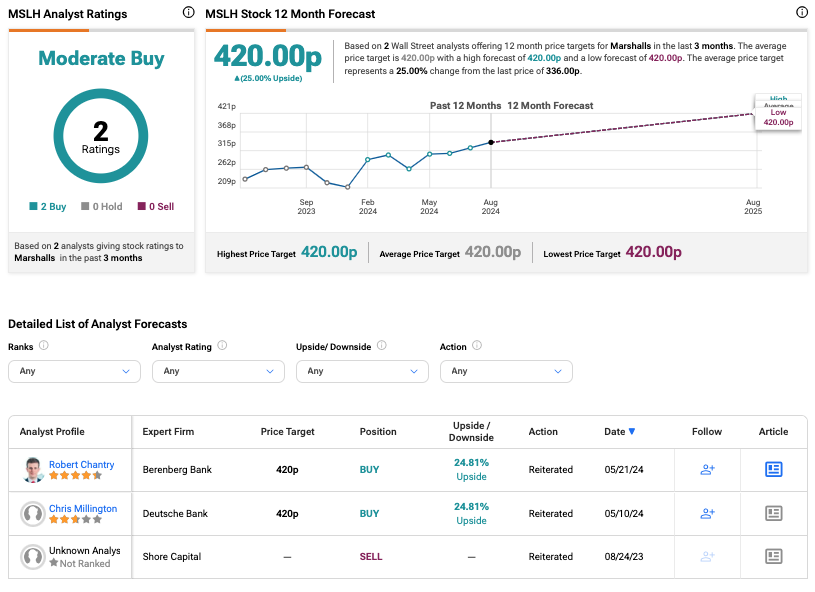

What Is the Stock Price Forecast for Marshalls?

According to TipRanks consensus, MSLH stock has received a Moderate Buy rating based on two Buy recommendations. The Marshalls share price target is 420p, which is 25% above the current trading levels.