Leading banking group HSBC Holdings PLC (GB:HSBA) has allocated up to $3 billion to share buybacks after its Q2 profits exceeded analysts’ forecasts. The bank’s reported pretax profit increased by about 2% year-over-year to $8.9 billion, surpassing the $7.88 billion anticipated by analysts. HSBC shares gained 2.76% as of writing.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The announcement also marked the last set of results under the leadership of HSBC’s CEO Noel Quinn. The bank will welcome its finance head, Georges Elhedery, as the new CEO in September.

Highlights from HSBC’s Results

In the first half, HSBC’s pre-tax profits remained stable at $21.6 billion as compared to the prior-year corresponding period. The bank experienced gains from increased customer activity in its Wealth and Personal Banking and Global Banking and Markets divisions. Revenue increased by 1% to $37.3 billion in H1 2024 compared to the first half of 2023.

However, net interest income decreased by 7% year-over-year to $16.9 billion in the first half, while the net interest margin dropped to 1.62% from 1.7% a year ago.

In terms of shareholder returns, HSBC announced a second interim dividend of $0.10 per share, similar to the previous year’s payment.

HSBC’s Outlook

HSBC raised its full-year net interest income forecast to $43 billion from an earlier projection of $41 billion. However, it stated that this projection is dependent on the trajectory of global interest rates. Also, the bank is aiming for a RoTE (return on average tangible equity), excluding notable items, in the mid-teens for both 2024 and 2025. In the first half of 2024, RoTE (annualized) was 21.4%, down from 22.4% in the first half of 2023.

Is HSBC a Good Stock to Buy?

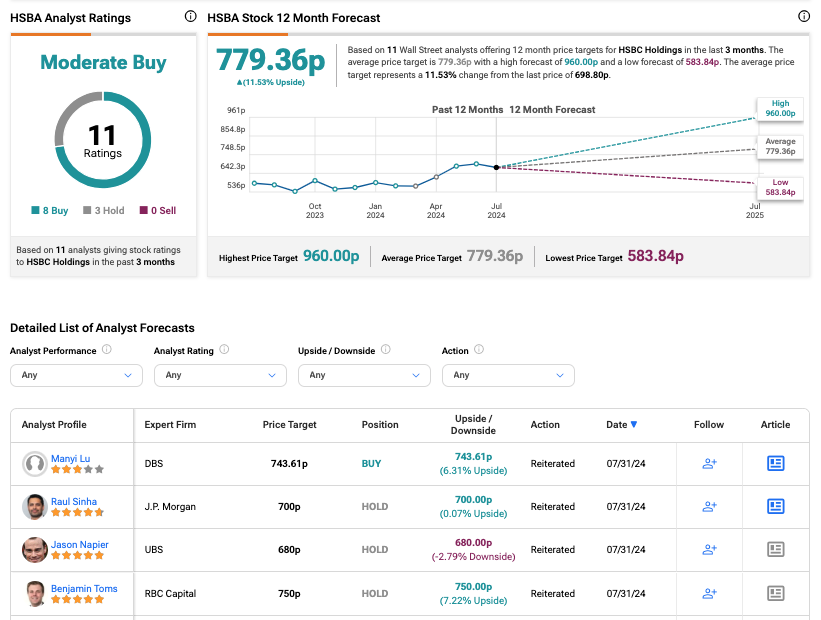

Following the results, DBS confirmed its Buy rating while analysts at J.P. Morgan, UBS, and RBC Capital maintained their Hold ratings.

According to TipRanks consensus, HSBA stock has received a Moderate Buy rating based on 11 recommendations, including eight Buys and three Holds. The HSBC share price target is 779.36p, which is 11.5% above the current trading level.