UiPath (NYSE:PATH) is scheduled to announce its results for the first quarter on Wednesday, May 29. The company is expected to have benefited from increased enterprise spending and solid demand for its robotic process automation tools. Also, PATH’s strong brand awareness and introduction of new products might have supported the company’s top-line growth in Q1.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

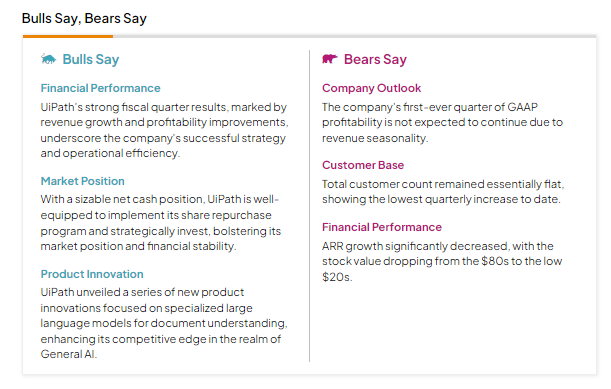

According to the TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” analysts bullish on PATH believe that the launch of new products focused on large language models enhances the company’s competitive position.

PATH – Q1 Expectations

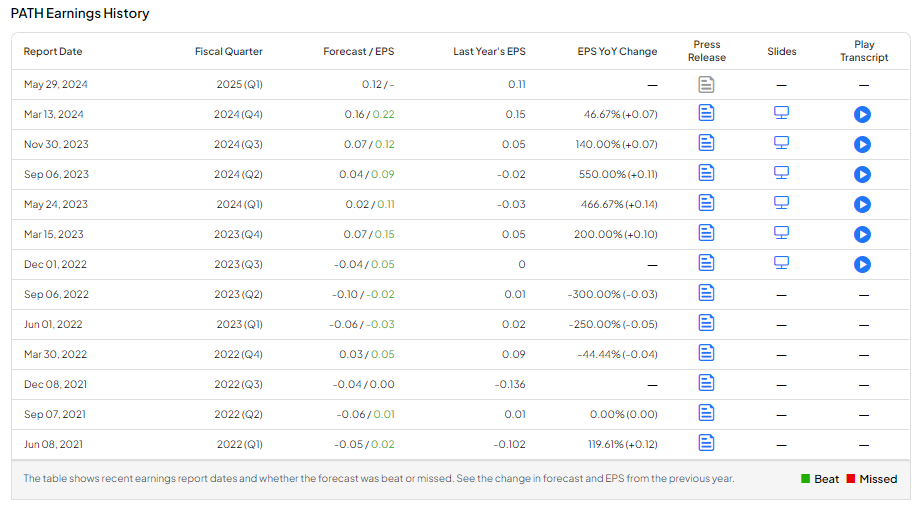

Wall Street expects UiPath to report sales of $333.09 million in Q1, up about 15% year-over-year. Meanwhile, analysts expect PATH to post earnings of $0.12 per share, compared with $0.11 in the prior-year quarter.

Interestingly, UiPath has an impressive earnings beat history, as it has surpassed expectations in each quarter since June 2021, except for once.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry; the Options tool does this for you. Indeed, it currently says that options traders are expecting a large 13.12% move in either direction.

Is PATH a Good Stock to Buy?

Overall, Wall Street is cautiously optimistic about the stock. PATH has a Moderate Buy consensus rating based on nine Buy and 10 Hold recommendations. After a 19.9% decline in its share price over the past three months, the analysts’ average price target on UiPath stock of $27.50 suggests an impressive upside of 44.89%.

Concluding Thoughts

Strong demand for PATH’s process automation and efforts to improve AI offerings bode well for long-term growth. Furthermore, the company’s focus on building a customer base with $1 million or more in ARR (annual recurring revenue) is expected to have aided revenues in the upcoming quarter.