The United Auto Workers (UAW) union, led by President Shawn Fain, is hitting automaker Stellantis (STLA) with strike threats once again. Last evening, Fain informed workers that the union was setting up the stage to prepare for a work stoppage and preparing to hold strike authorization votes for some UAW locals. The votes do not imply an immediate strike but indicate members’ support in favor of one.

Fain informed that the union has to proceed in a step-wise manner before actually calling a strike. Its efforts include numerous face-to-face negotiations with Stellantis’ management. Last month, the UAW threatened to stage a walkout if the company backtracked on the commitments made in the 2023 contract. UAW went on strike for six weeks in 2023 before agreeing on a renewed labor contract that favored both parties.

Stellantis’ Mounting Troubles

The UAW is alleging that Stellantis is trying to shift some of its SUV auto manufacturing outside of the U.S. The union is also pushing Stellantis to fulfill its promise to restart the Belvidere factory and add more jobs.

In response, Stellantis spokesperson said that the union has no basis to call a full-fledged strike. The company states that they have not violated any clause in the 2023 contract. They have the right to change production plans depending on the “market conditions.” Stellantis stated that it is delaying the opening of the Belvidere plant to 2027.

Stellantis is already facing growing tensions from dealers who are claiming that CEO Carlos Tavares has tarnished the quality of autos and the brand name. The diminishing auto demand following the post-pandemic boom and macro challenges have changed consumers’ buying preferences. Dealers are left with huge inventory pileups and are urging Stellantis to allow discounts to clear them. According to Cox Automotive, Stellantis’ share of the U.S. market in the first six months fell to 8.5% from 10.4% a year ago.

Insights from TipRanks’ Bulls Say, Bears Say Tool

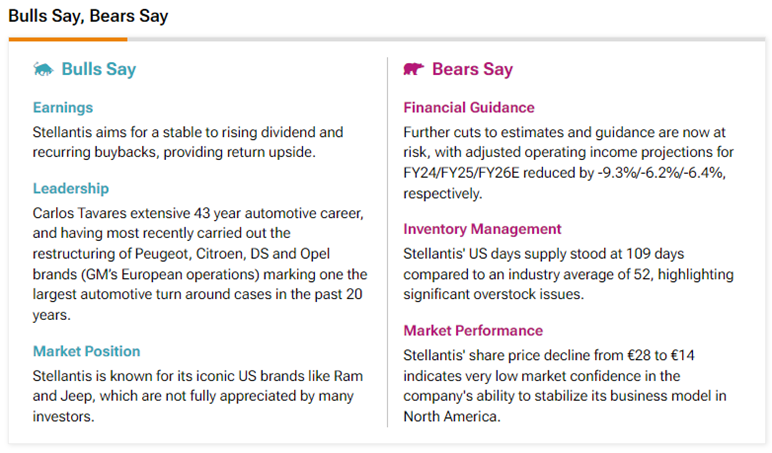

Amid the union pressures, Wall Street analysts have very differing views on STLA stock owing to the current challenges and opportunities facing the company. According to TipRanks’ Bulls Say, Bears Say tool, some analysts are highly encouraged by CEO Tavares’ extensive experience in handling challenges, the company’s efforts to boost dividends and buybacks, and its iconic brands.

On the other hand, Bears are concerned about guidance cuts, overstocking problems, and the declining share price.

Is STLA a Good Stock to Buy?

Analysts are divided on Stellantis stock’s trajectory. On TipRanks, STLA stock has a Moderate Buy consensus rating based on nine Buys, seven Holds, and two Sell ratings. The average Stellantis price target of $22.15 implies 46.7% upside potential from current levels. Year-to-date, STLA shares have declined 30.8%.