With Donald Trump’s victory in the presidential election, as expected, traders’ recent bullish bets on Trump Media Technology Group (TMTG) (DJT) stock have paid off. Over the past month, the stock surged nearly 95% by November 6, the day following the election. However, this surge was clearly driven by the election outcome, with euphoria at an all-time high. The stock opened the November 6 session with a 30% pre-market spike, only to close the day with a somewhat disappointing gain of less than 6%. Given these factors, I believe it’s time to sell TMTG shares.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

While volatility is likely to continue in the coming weeks, if not months, I now see more negative catalysts than positive ones for speculators, especially with the company reporting disappointing earnings results.

In this article, I’ll delve into these issues and explain why now may be the ideal time to take a bearish stance on DJT.

DJT’s Largest Shareholder Is Now the President of the U.S.

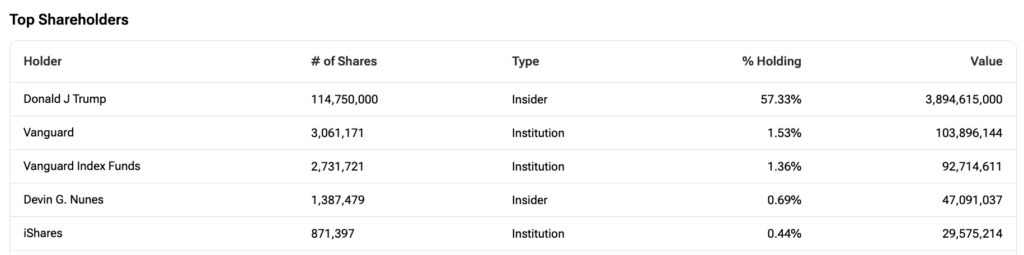

My skepticism about DJT stock has always been based on the belief that it is more of a bet on Donald Trump’s political moves than an investment grounded in the company’s ability to generate value for shareholders through Truth Social. As such, Trump Media stock has traded in an extremely volatile manner leading up to November 5 Election Day, culminating in a victory for its largest shareholder, the re-elected President Donald J. Trump. Trump holds around 57% of the company’s total shares, a stake now worth nearly $4 billion.

In the weeks leading up to Election Day, Trump Media’s stock surged to over $50 per share, driven by betting odds that pointed to a victory by a significant margin. While momentum slowed as Election Day progressed, the stock dropped back to around $30 per share at the beginning of November. However, it surged again to over $45 after the election results confirmed Trump’s victory.

To be honest, I was somewhat disappointed that the stock only surged by up to 30% after hours, capitalizing on Trump’s win, and quickly lost momentum when the market opened on November 6th. I had expected DJT to behave more like a meme stock, with the election victory acting as a massive catalyst capable of driving triple-digit gains, creating volume spikes, and squeezing short sellers. I believe that the anticipation surrounding the election, fueled by online gambling sites like Polymarket, had effectively turned Trump’s reelection chances into a proxy for DJT’s stock price. This dampened the element of surprise and limited the bullish, meme stock-style reaction that many had anticipated.

A Word on DJT’s Latest Earnings

Another factor that supports a negative outlook for Trump Media is its recent earnings report, which was conveniently released just after the election results. This timing appeared to be a clever strategy to capitalize on the buzz surrounding Trump’s victory, distracting from the company’s disappointing financial results.

To start, Trump Media reported just $1 million in revenue for the third quarter, along with $4.7 million in interest income from its $673 million in cash and short-term investments on its balance sheet. If there is one positive aspect to highlight in Trump Media’s financials, it’s the strength of its asset base. During the quarter ended September 30, Trump Media raised $339.5 million from a purchase of 17,330,365 shares of common stock from Yorkville, at prices ranging from $14.31 to $36.13 under the terms of a Securities Purchase Agreement (SEPA). This agreement allowed the company to secure capital while offering the investor the flexibility to acquire shares at their discretion.

This capital raise provides a degree of financial stability for Trump Media, especially given that the company reported a negative operating cash flow of $52 million over the past 12 months.

More Negative Than Positive Catalysts Ahead

To further reinforce my bearish outlook on DJT stock, it’s impossible to ignore that the stock is severely overvalued, trading at a disconnected and unjustified valuation, with a market cap exceeding $7 billion—despite generating a mere $3.4 million in revenue over the past twelve months and offering absolutely no future guidance. In the wake of the election, the stock is facing far more negative catalysts than any potential upside, and the risks far outweigh any possible rewards.

First, much of the initial buzz around the stock was driven by an ultra-bullish reaction to Trump’s election victory. While this reaction was certainly positive over the past few months, I believe traders will lose interest in the stock over the coming days and weeks. Although volatility may persist to some extent, it is unlikely to remain at the extreme levels seen in the immediate aftermath of the election.

Another concern is the risk of President Donald Trump selling some of his shares. It’s important to note that the lock-up period for selling stock has already passed. While Trump has publicly stated that he will not sell shares, he will face pressure to keep his word—even if it means passing up billions in potential profits. If he does choose to sell, I anticipate this could trigger a massive selloff in DJT stock.

Conclusion

With Donald Trump’s victory in the presidential election serving as the main catalyst for stocks this year, I believe the peak of attention around DJT has already been reached, and I don’t foresee sustained bullish momentum in the short to mid-term. Despite having sufficient cash reserves, the company’s fundamentals are weak, and its valuations are entirely speculative.

That said, while I consider Trump Media stock a Sell, it’s important to note that because its largest shareholder is the President of the United States, volatility is likely to persist. Furthermore, Trump’s actions in the Oval Office could have significant repercussions on the stock, both positively and negatively.