Phillip Juhan, chief financial officer (CFO) of Trump Media & Technology Group (DJT), has filed plans with regulators to sell $13.1 million of company stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Juhan has adopted a Rule 10b5-1 plan to sell 400,000 shares between this November and December 2025. Based on the current DJT stock price of $32.76, those shares are currently valued at $13.1 million. Trump Media disclosed the stock sale in a filing with the U.S. Securities and Exchange Commission (SEC).

Company insiders use 10b5-1 plans to remove the appearance of bias or that they are profiting from insider information. Plans execute trades automatically when preset conditions such as price, volume, and timing are met.

Big Price Swings in DJT Stocks

Juhan’s most recent sale of Trump Media stock occurred on November 5, the day of the U.S. election, when he sold 244,739 shares valued at $7.3 million. The CFO of Trump Media & Technology Group, which runs the Truth Social platform that is modeled after X, still owns 649,798 shares of DJT stock.

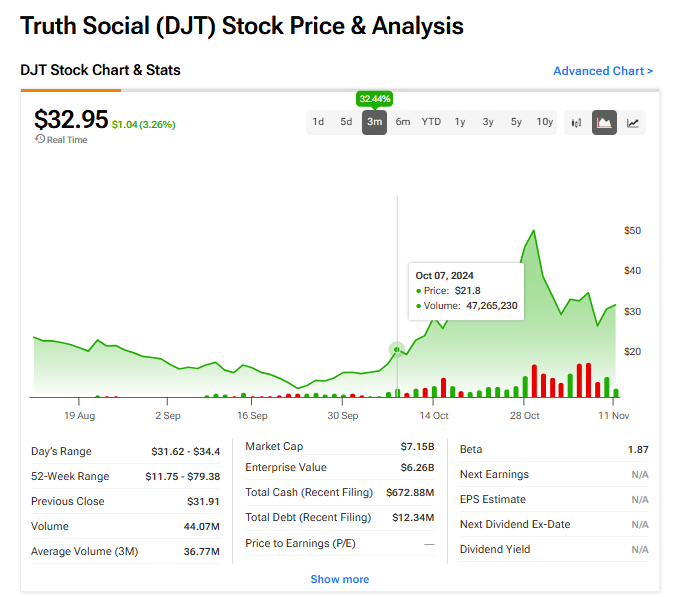

Trump Media stock, which is majority owned by Donald Trump, remains extremely volatile and prone to big price swings. In the last five trading sessions, DJT stock has declined 22%. However, it is up 87% since going public earlier this year.

Is DJT Stock a Buy?

No analysts currently offer ratings or price targets on Trump Media & Technology Group. So instead we turn to the three month performance of DJT stock. As indicated by the chart below, despite ongoing volatility, the company’s share price has risen 32% over the past three months.