Traeger, Inc. (NYSE: COOK) shares lost almost a fifth of its market capitalization during the extended trading session on March 23, after the cooking equipment retailer reported stronger-than-expected Q4 results, but provided FY2022 revenues guidance much below streets expectations.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Q4 Beat

Q4 adjusted earnings of $0.03 per share remained flat year-over-year, but beat analysts’ expectations of a loss of $0.05 per share.

Positively, revenues jumped 30.8% year-over-year to $174.9 million and exceeded consensus estimates of $158.54 billion. The increase in revenues reflects strong performance across the business segments.

Region-wise, North America revenues increased 19.6% driven by strong growth in the US and continued strength in Canada, while the Rest of the World saw revenues increase by a whopping 439.5% aided by robust growth in core international markets.

However, despite top-line outperformance, gross profit margin declined 80 bps to 37.4% due to higher freight costs and logistics costs partially offset by price actions taken in the second half of the year.

Muted FY2022 Outlook

Based on the effects of inflationary pressures and geopolitical conflicts on consumer sentiment and discretionary spending, as well as gross margin pressures due to global supply chain challenges, management provided a muted outlook for FY2022.

For FY2022, revenues are forecast to be in the range of $800 million to $850 million, much lower than the consensus estimate of $955 million. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) is projected to be between $70 million and $80 million.

For the fiscal first quarter, revenues are projected to be in the range of $208 million to $212 million, while adjusted EBITDA will range between $22 million and $24 million.

CEO Comments

Traeger CEO, Jeremy Andrus, commented, “While we are projecting lower than typical growth in 2022, our strong multi-year growth CAGR and market share gains give us confidence in our long-term opportunity to grow household penetration and to disrupt the grilling category. ”

He further added, “Despite near-term headwinds, we are very excited about the upcoming year with significant new product innovation throughout our categories and we remain focused on executing strategic initiatives that we believe will drive long-term shareholder value.”

Wall Street’s Take

Disappointed by the lowered FY2022 outlook, Stifel Nicolaus analyst Jim Duffy downgraded Traeger from Buy to Hold and also significantly lowered the price target to $7.50 (14.77% downside potential) from $26.

Duffy’s downgrade of Traeger is based on a reduced outlook by management as a result of weak grill sell-through and worsening supply chain headwinds.

The analyst was further disappointed by declining grill revenue trends commentary early in the grill selling season. Price increases combined with continued supply chain/logistics may negatively impact the margins and profitability for the stock increasing the risk profile of the stock.

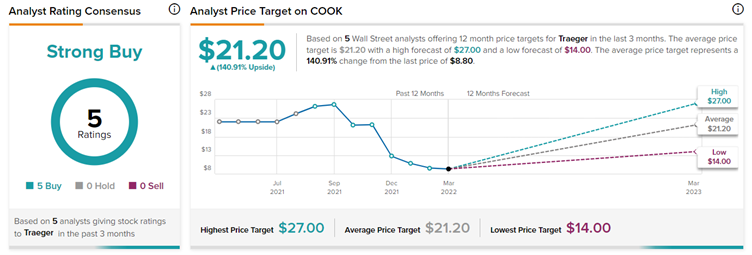

Turning to Wall Street, the analyst consensus is, however, optimistic about Traeger, with a Strong Buy rating based on five Buys. The average Traeger price target of $21.20 indicates an upside potential of 140.91%, at the time of writing.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

On Holding Delivers Robust Q4 Sales & Outlook; Shares Gain 14%

Pinduoduo Smashes EPS Estimates; Shares Gain 6% Pre-Market

Williams-Sonoma Shares Gain 8.2% on EPS Beat & 10% Dividend Hike