Top Truist Analyst William Stein reiterated a Hold rating on Tesla (TSLA) stock with a price target of $406. While the analyst acknowledges that the recent approval of CEO Elon Musk’s pay package removes a major overhang for the electric vehicle (EV) maker, he prefers to stay on the sidelines as he believes that the “set-up is still tricky” for Tesla. Let’s look at the reasons for Stein’s cautious stance.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Interestingly, a group of activists is planning a protest called “Tesla Takedown” on November 15 to oppose Musk’s $1 trillion pay package.

Truist Analyst Remains Cautious on TSLA Stock

Stein views the recent shareholder approval of Musk’s equity compensation as a favorable development that removes a major uncertainty about the CEO leaving the EV company to develop physical artificial intelligence (AI) products elsewhere (his other company xAI). That said, the 5-star analyst is concerned about the road ahead, as Tesla’s “physical AI products are still a long way off.”

Stein agrees that a significant portion of the company’s current and future value is tied to the development of physical AI technology – full self-driving (FSD), robotaxis, and the Optimus humanoid robot. However, the analyst contends that all these projects are largely “unproven,” with “close to zero revenue.” While Stein’s assessment of Tesla’s FSD technology indicates that it is impressive, it is not yet delivering results as expected.

Overall, while Musk has made it clear that Tesla’s future lies in AI, several analysts remain concerned that none of these projects have proven their worth as of now. At the same time, Tesla’s EV business is under pressure due to intense competition.

Is Tesla Stock a Buy Now?

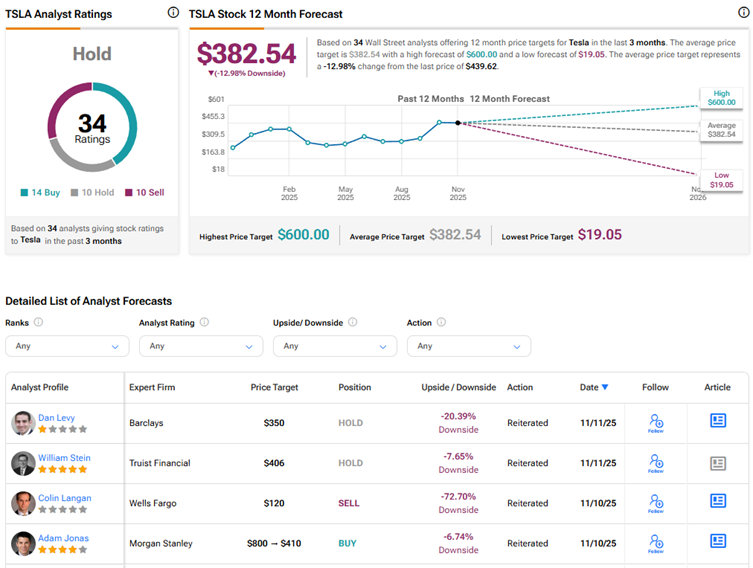

Currently, Wall Street has a Hold consensus rating on Tesla stock based on 14 Buys, 10 Holds, and 10 Sell recommendations. The average TSLA stock price target of $382.54 indicates 13% downside risk. TSLA stock has risen 8.4% year-to-date.