T-Mobile US (TMUS) reported robust results in the second quarter and raised its FY24 forecast. The telecom major reported adjusted earnings of $2.49 per share, an increase of 34% year-over-year, which was above analysts’ expectations of $2.28 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

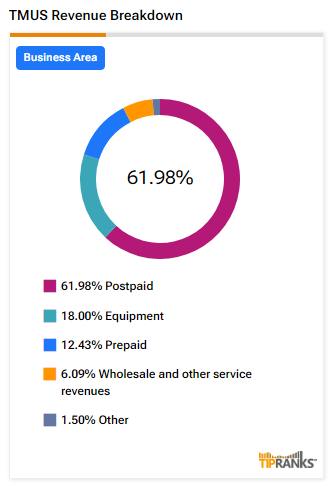

TMUS’s Q2 Revenue Breakdown

The telecommunications major posted revenues of $19.7 billion, up by 3% year-over-year, and above analysts’ expectations of $19.6 billion. As competition rises in the telecom sector in the U.S., carriers in the United States are bundling streaming services with high-speed internet plans to attract more customers.

In fact, the company’s management stated that T-Mobile’s Go5G Next and Go5G Plus plans, which include Netflix (NFLX) and Apple TV+ (AAPL), are “seeing fabulous uptake.” Furthermore, around 30% of TMUS’s postpaid subscribers have opted for the Go5G Next and Go5G Plus plans.

T-Mobile’s Postpaid Revenues in Q2

In the second quarter, T-Mobile added net postpaid phone customers of 777,000, the best in the industry and the highest in the second quarter in the company’s history. This was above consensus estimates of 642,000 net additions.

The company’s postpaid service revenues grew 7% year-over-year to $12.9 billion and comprised more than 60% of TMUS’s total revenues in Q2.

TMUS Raises FY24 Outlook

The company raised its outlook for postpaid net customer additions due to strong demand for its discounted unlimited plans with streaming perks. Postpaid net customer additions are expected to be between 5.4 million and 5.7 million, an increase from its prior guidance in the range of 5.2 million to 5.6 million. Core adjusted EBITDA, that is, adjusted EBITDA less lease revenues, is expected to be between $31.5 billion and $31.8 billion, compared to its prior guidance in the range of $31.4 billion to $31.9 billion.

Is TMUS a Good Stock to Buy?

Analysts remain bullish about TMUS stock, with a Strong Buy consensus rating based on a unanimous 17 Buys. Over the past year, TMUS has increased by more than 25%, and the average TMUS price target of $191.96 implies an upside potential of 7.8% from current levels. These analyst ratings are likely to change following T-Mobile’s results today.