Shares of WWE and UFC parent company, TKO Group (NYSE:TKO), are in the green today as Vince McMahon continues to reduce his stake in the company. For decades, McMahon was the face of the WWE, its executive chairman, and its top shareholder prior to last year’s merger with UFC. Therefore, it might seem odd for the company’s stock to rally on the news of a major insider sale.

In fact, he is planning to sell $311.2 million worth of shares, with $146.2 million coming from Endeavor (NYSE:EDR) and the rest from TKO itself. However, it’s worth noting that Vince McMahon has been caught up in a series of sexual abuse scandals which don’t do any favors to the company’s image. In addition, TKO Group is essentially performing a buyback, and it will retire those shares once the transaction is complete.

Is TKO a Good Stock to Buy?

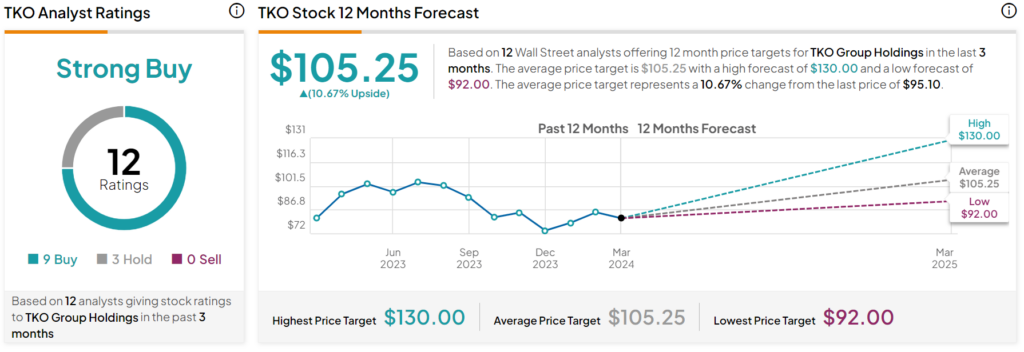

Turning to Wall Street, analysts have a Strong Buy consensus rating on TKO stock based on nine Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 16.7% year-to-date rally, the average TKO price target of $105.25 per share implies 10.67% upside potential.