After a brief dip earlier this month, the S&P 500 is once again approaching all-time highs. This resurgence signals strong investor confidence in stocks, suggesting that the bullish momentum is far from over.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The only question is, which stocks are poised to ride this bullish wave?

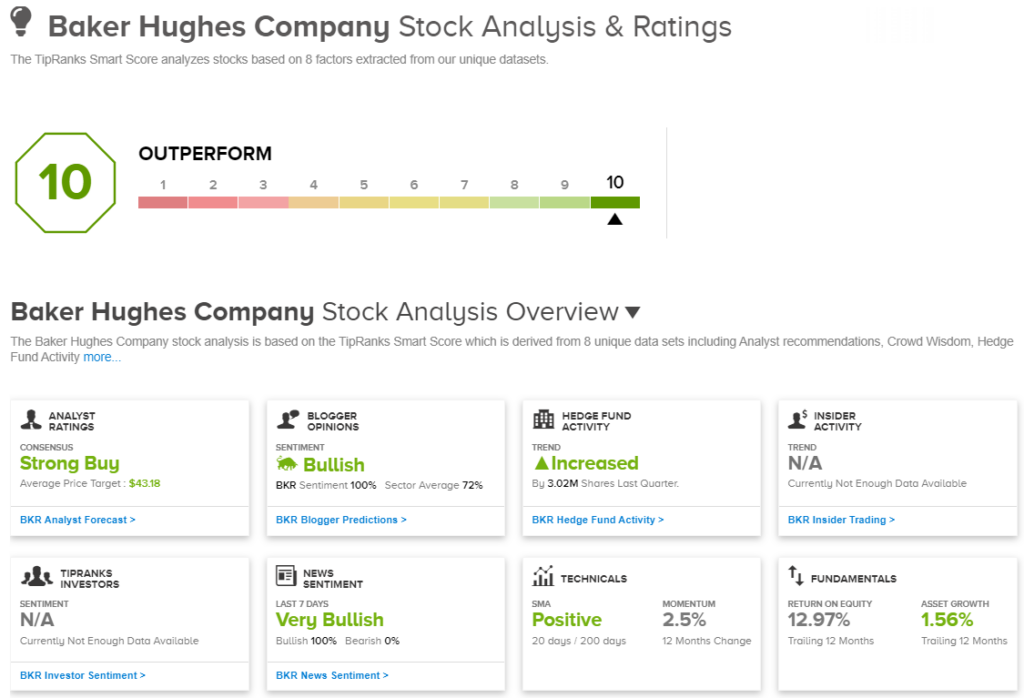

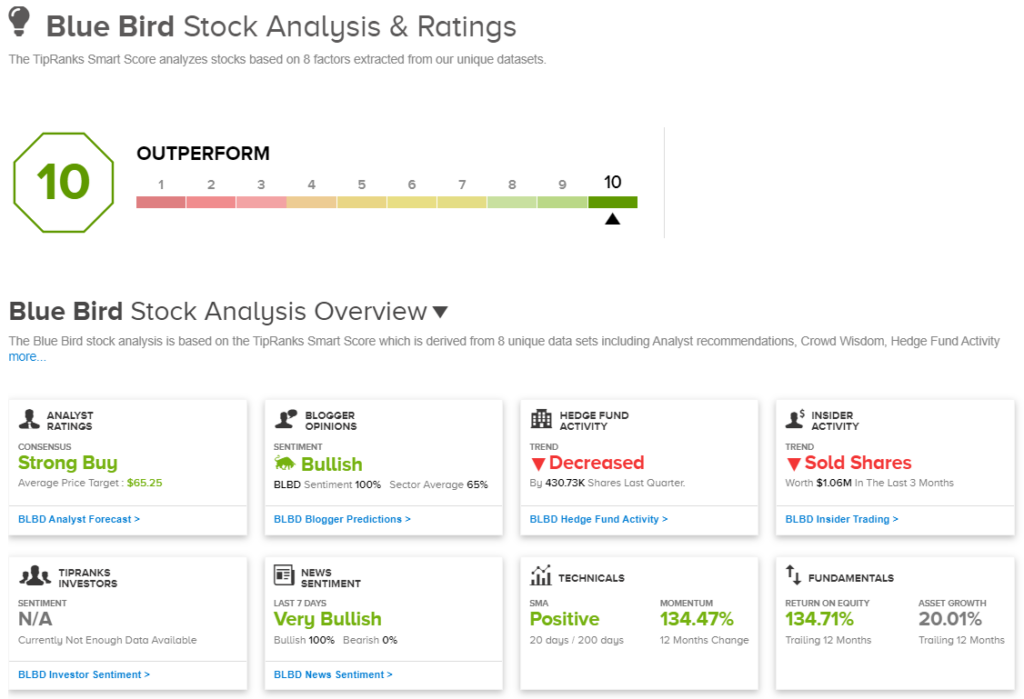

This is where investors can turn to the Smart Score. This sophisticated data tool, based on AI and machine learning algorithms, gathers and collates the aggregated data of the stock markets and uses it to compare each stock to a set of factors that are known to correlate with future outperformance. The end result is a single score for each stock, on an intuitive scale of 1 to 10, with the ‘Perfect 10’ being the highest – and indicating stocks that deserve some added attention.

The Smart Score lets investors tell at a glance where a stock’s main chance is likely to take it. We can follow those indicators, using the Smart Score as a guide to locate quality shares with solid prospects. We’ve gotten a start on this – and found 2 ‘Perfect 10’ names that the analysts see as solid opportunities. Here are the details on two of these top-scoring stocks.

Baker Hughes Company (BKR)

We’ll start in the oil patch, where Baker Hughes is a long-time leader in the oil field services niche. Baker Hughes is an advanced industrial technology firm, working at both the development and deployment of the energy technology needed to maximize production and efficiency in the world’s hydrocarbon production regions. Baker Hughes works with oil and natural gas producers, as well as industrial firms, to provide streamlined solutions for the development of clean and reliable energy. The company is known for its leadership and solutions in the liquified natural gas industry.

Energy is needed worldwide, and Baker Hughes has a global reach. The company operates in more than 120 countries, and employs over 58,000 people. In an important announcement this past May, the company publicized its new contract with SONATRACH for boosting natural gas production in Algeria. The project is an important facet of the energy supply chain for Europe, and for Italy in particular.

Looking at Baker Hughes’ financial results, we find another set of solid data to support the stock. Baker Hughes reported 2Q24 revenue of $7.1 billion, up almost 13% year-over-year and beating the forecast by some $300 million. The company’s bottom line, by non-GAAP measures, came to 57 cents per share, a figure that was 8 cents per share better than had been expected. The company’s Q2 results also featured new orders worth $7.5 billion, including $3.5 billion in IET orders.

For return-minded investors, we should note that Baker Hughes has a long-standing commitment to maintaining regular dividend payments, with a payment history stretching back to 1989. The last quarterly dividend was paid out on August 16, at 21 cents per share. This annualized to 84 cents and gave a forward yield of 2.4%. In the second quarter of this year, Baker Hughes paid out a total of $209 million in dividends, and supported that cash return with $166 million worth of share repurchases.

Altogether, this picture has attracted the attention of Evercore analyst James West. West is particularly impressed by this company’s ability to leverage its expertise in specific energy niches, as well as its strong execution and regular cash returns.

“Baker continues to improve and optimize its performance by capitalizing on opportunities in the OFSE, LNG, New Energies, and emerging areas in IET. The company’s strategy is clearly defined, focusing on four key objectives: 1) executing commercially in a strong energy cycle, 2) leveraging the new organizational structure for enhanced performance and returns, 3) developing the new energy portfolio, and 4) generating strong free cash flow and returning cash to shareholders… We continue to rate the shares Outperform,” West opined.

That Outperform (i.e. Buy) rating is backed up by a $46 price target, which implies a one-year upside potential of ~31%. (To monitor West’s track record, click here)

Overall, BKR shares have earned a Strong Buy consensus rating from the Street’s analysts, based on 17 recent reviews that include 15 Buys and 2 Holds. The shares are priced at $35.16 and their $43.18 average target price suggests that BKR will gain ~23% or better in the coming months. (See BKR stock analysis)

Blue Bird (BLBD)

The next company we’ll look at is Blue Bird Corporation, a firm you’ve probably never heard of – although you’ve probably also used their main product. This industrial manufacturing company is based in Georgia and has been in business for more than 90 years, building a variety of specialized vehicles: buses, motor homes, mobile libraries, and mobile police command centers. From its beginning, however, Blue Bird has been closely associated with the development, manufacture, and distribution of school buses, and is one of the largest suppliers in this niche.

Blue Bird employs some 1,500 people, and has a network of dealers and distributors across North America. The company is active globally, and its products can be found in 60 countries around the world. Blue Bird’s goal as a company is to design, build, and distribute the world’s finest school buses.

On the financial side, Blue Bird reported revenues of $333.4 million in its last quarterly results, covering fiscal 3Q24. This represented a nearly 13% year-over-year increase, and beat the estimates by $6.72 million. The revenues supported non-GAAP earnings of 91 cents per share, an impressive 40 cents per share over the forecasts.

Shares in Blue Bird reflect this earnings strength; the stock is up 78% for the year-to-date, and is up 120% in the last 12 months.

Analyst Chris Pierce, covering this stock for Needham, sees sound prospects for continued growth, writing of the company and its shares: “BLBD is on pace for high teens y/y revenue growth on 5% unit growth, benefiting from pricing actions on legacy fueled school buses and a ~3x ASP premium on subsidized ESBs. BLBD’s guidance calls for ~600bps of adj EBITDA margin leverage driven by gross margin acceleration from price gains and ESB mix benefits. We expect momentum to continue on both fronts, with the school bus industry in the early innings of a cyclical recovery, and a long dated runway of customer ESB allocations and final deliveries.”

These comments support a Buy rating on the stock, and Pierce adds a $72 price target to that, indicating his confidence in a 50% upside potential for the next 12 months. (To watch Pierce’s track record, click here)

All in all, Blue Bird’s Strong Buy consensus rating is unanimous, based on 5 recent positive analyst reviews set in recent weeks. The stock is currently selling for $47.87 and its $65.25 average price target suggests it will appreciate by 36% this coming year. (See BLBD stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.