Amazon (NASDAQ:AMZN) transformation from a modest online bookseller to a tech powerhouse seems almost legendary now. Today, the company dominates various sectors, from e-commerce to cloud computing, with Amazon Web Services (AWS) contributing more than half of its annual operating profit.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Like (most of) its ‘Magnificent Seven’ peers, Amazon’s stock has seen solid gains this year, rising by 24%. The big question is how much longer can this upward momentum continue, and is the valuation becoming too steep to justify a position?

One investor, known by the pseudonym Envision Research, believes that Amazon is still ascending.

“Its valuation ratio is much lower than what’s on the surface when based on owner’s earnings,” writes the 5-star investor.

Envision had previously expressed cautious optimism regarding Amazon, worried about “uncertainties” in the retail sector. However, the recent success of Prime Day, when consumers saved over $1 billion in deals, has allayed many of the investor’s concerns.

In fact, Envision sees “several ongoing catalysts that could first drive up the profitability of the retail segment and also the overall EPS growth for the company.”

Among these catalysts are Amazon’s One Medical primary care services, the expansion of online vehicle sales, and improvements to freight and fulfillment in the U.S., with similar cost-saving opportunities available abroad.

In addition, the investor believes that “the current accounting earnings dramatically underestimate its true owners’ earnings (by more than 20% in my estimate) due to the large-growth capex investments made recently.”

Envision differentiates between growth capex and maintenance capex, while arguing that growth capex should be factored into earnings. Amazon’s recent capex outlays mostly consist of spending on AI-related projects, which fall firmly into the growth capex category.

According to this new calculus, Envision estimates Amazon’s P/E at 32.9x – considerably lower than the traditionally calculated 40x.

“Its owners’ earnings have consistently exceeded both its accounting EPS and also free cash flow in the past, a hallmark of a growth stock,” Envision summed up.

Viewing Amazon stock as “considerably cheaper” than perceived, Envision rates it a Strong Buy. (To watch Envision Research’s track record, click here)

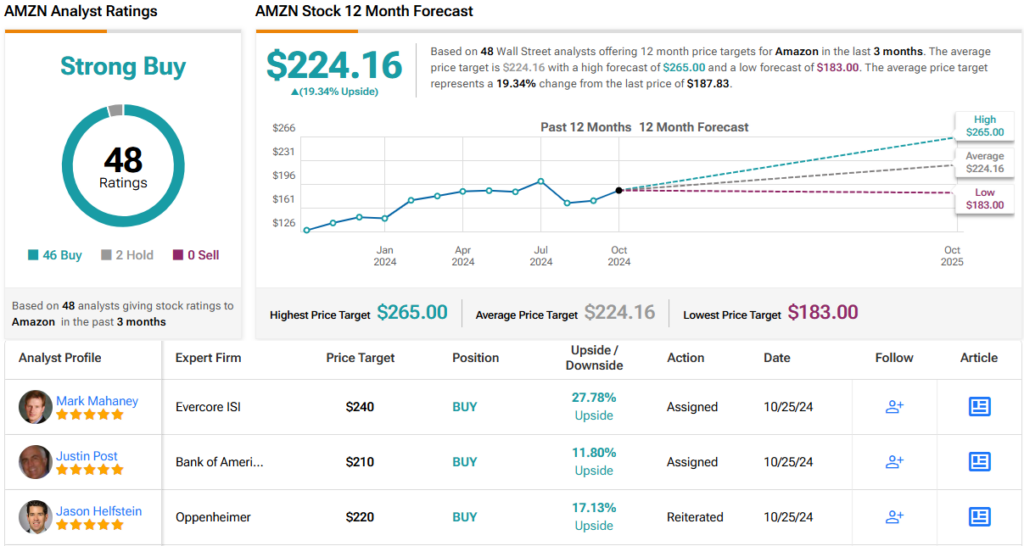

Envision’s views are reflected on Wall Street, where the heavily-covered stock has 46 Buy and 2 Hold ratings. This gives AMZN a consensus rating of Strong Buy, and its 12-month average price target of $224.16 implies gains of almost 19%. (See AMZN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.