Tesla (NASDAQ:TSLA) revolutionized the U.S. EV market, harnessing its first-mover advantage to capture an astonishing 80% share at its peak. Today, however, that dominance has faded to nearly half – still impressive, yet indicative of rising competition as established automakers and new entrants alike amplify their efforts.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

For investors, the ride has been bumpy this year. Despite a broader market rally, Tesla’s shares have posted only modest gains year-to-date.

Although a strong Q3 financial report provided a lift, one top investor remains cautious about the company’s future.

“The business continues to lose market share, and the stock is incredibly expensive at this time,” writes Daniel Jones, who sits in the top 3% of TipRanks’ stock pros.

Jones’ primary concern lies in the fierce competition, both domestically and abroad. As EV makers increasingly focus on affordable models, Jones warns that Tesla’s margins could be squeezed, ultimately impacting its bottom line.

In addition, the newly unveiled Cybercab is not slated for production until 2026 – significantly later than the 2019 target for the robotaxi network initially promised by CEO Elon Musk.

Valuation-wise, looking at a slew of different metrics, TSLA is an expensive buy with a forward P/E ratio for 2024 of 83.2, a P/AOCF of 61.9, and an EV/EBITDA ratio of 62.3.

“These are astronomical figures, especially for a company that I would consider to no longer fit the ‘high growth’ category of opportunities out there,” writes Jones.

The investor contrasts Tesla’s valuation with that of other major automakers, noting that TSLA is priced substantially higher than established names like Ford, GM, and Stellantis.

“Tesla has too many issues,” Jones summed up, rating the stock a Strong Sell. (To watch Jones’ track record, click here)

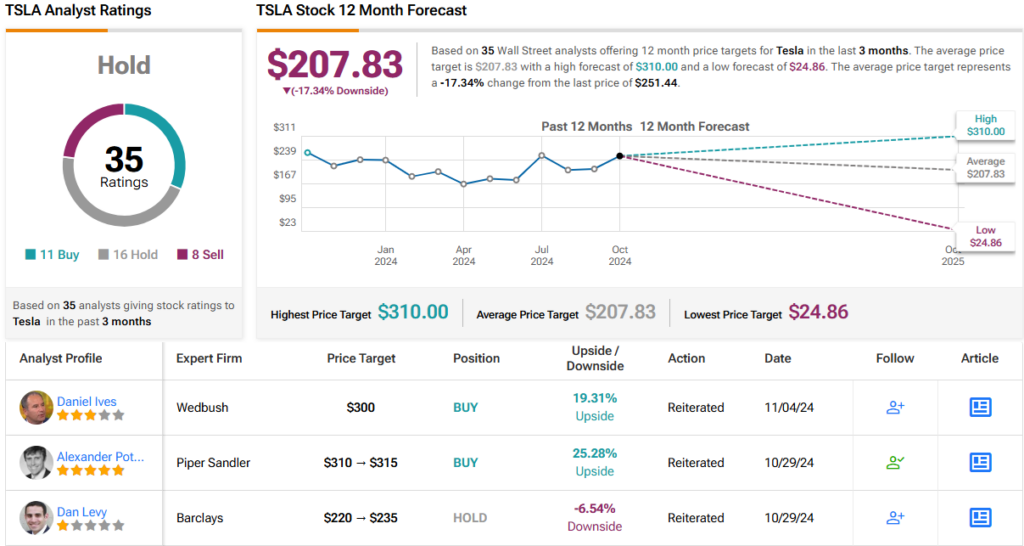

How does Wall Street view Tesla? Analysts reflect a blend of bulls, bears, and those in between. With 11 Buy, 16 Hold, and 8 Sell ratings, Tesla gets a Hold (i.e. Neutral) consensus rating. Its 12-month average price target of $207.83 implies a potential decline of nearly 17% from current levels. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.