Nvidia (NASDAQ:NVDA) has been on a remarkable winning streak over the past few years, dominating the AI chip market and securing a 90% share in the data center sector. Demand for its latest GPU, Blackwell, has been “insane,” according to CEO Jensen Huang, with chipsets already sold out for the next 12 months.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

This explosive growth has propelled Nvidia shares up by 173% year-to-date. Yet, one investor, known by the pseudonym Bluesea Research, sees potential risks on the horizon.

“There is a major red flag in Nvidia due to uncertainty in forward earnings,” Bluesea cautioned.

Bluesea believes that the vast difference of opinion between Nvidia bulls and bears regarding the company’s prospects is a big concern, as it reflects the two very different paths it might traverse. The investor points out that analysts – who have conducted “very in-depth analysis” – estimate a wide EPS range for the fiscal year ending January 2027, from a high of $7.29 to a low of $1.81. This 4x variance far exceeds what is typical among tech giants.

“Higher uncertainty is a sign that analysts are not sure about the ability of Nvidia to retain its current margins as competitive pressure increases over the coming years,” the investor argues.

According to Bluesea, such a margin squeeze is foreseeable. For instance, AMD may roll out competitive products at aggressive prices, Intel could undercut Nvidia, and hyperscalers are likely to push forward with developing their own AI chips.

All of this could trigger a “major correction” for Nvidia shares, whose forward price-to-earnings multiple 2 fiscal years out is 75% higher than Alphabet’s.

“The stock is quite expensive, and even an earnings beat might not be enough to deliver a further bullish run,” concludes Bluesea, who rates NVDA shares a Sell. (To watch Bluesea Research’s track record, click here)

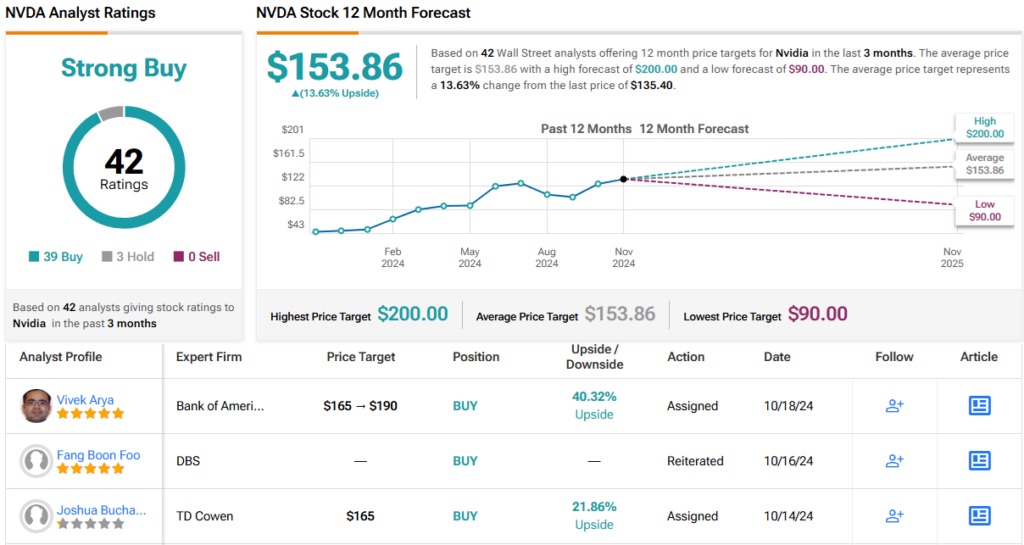

Bluesea’s pessimism does not seem to be reflected in the slightest on Wall Street. NVDA enjoys a consensus Strong Buy rating, with 39 Buy recommendations and 3 Holds. The stock’s 12-month average price target of $153.86 suggests a ~14% upside from current levels. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.