Cannabis stocks have experienced periods of both optimism and decline as the industry has grappled with regulatory obstacles, fierce competition, overcapacity, and cash burn. Yet, there is a new wave of hope on the horizon. Regulations around the world are becoming more cannabis-friendly, with Germany being the latest country to legalize, while the United States is on the cusp of reclassifying cannabis as a Schedule III drug. This would massively open the market and allow exponential recreational and medicinal growth. Consequently, it’s expected to significantly boost cannabis companies like Tilray (TLRY).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company is well-positioned to benefit from future growth in the sector, making this a potential window of opportunity for investors interested in exposure to a dynamic industry.

Tilray Lays the Groundwork for Accelerated Growth

Tilray Brands is a global company that showcases an impressive, diverse product line, including beverages, cannabis, and wellness items. It caters to both adult-use and medical cannabis markets, offering a variety of products such as whole flowers, pre-rolls, vapes, oils, and THC-infused drinks. Its reach is also significant, with operations spanning over 20 countries across five continents, sporting 44 brands crafted at 20 vertically integrated facilities.

Diversification is a key focus for the company. it broadened its portfolio to become the biggest cannabis venture in Canada, the top medical cannabis entity in Europe, and the fifth-largest craft beer brewer in the U.S.

Financially, Tilray is in a strong position. The company announced a $250 million offering designed for acquisitions and expansion in the U.S., given the potential reclassification of cannabis as a Schedule III drug. This strategic move could accelerate growth and increase stock value over the next few years.

Analysis of Tilray’s Recent Financial Results

For the first quarter of FY 2025, Tilray reported a 13% year-over-year net revenue increase, rising to $200 million from $177 million during the same period the previous year. However, this fell short of analysts\ expectations by $20.8 million. This growth was fueled by the beverage alcohol segment, including craft beer, spirits, and non-alcoholic beverages, which saw a remarkable 132% increase in net revenue. At the same time, the cannabis and wellness segments also reported solid performance.

Gross profit for the company saw a notable 35% increase, reaching $59.7 million, up from $44.2 million from the previous year. This increase in profit led to a substantial improvement in gross margin, from 25% to 30%. Net loss for the quarter also saw improvement, decreasing by 38% to $34.7 million, compared to the previous year’s first-quarter loss of $55.9 million. The adjusted net loss of $0.01 per share also showed progress, shrinking from the prior year’s per-share loss of $0.04 while beating consensus projections by $0.03.

What Is the Price Target for TLRY Stock?

The stock has been downward, shedding over 84% in the past three years. It trades at the lower end of its 52-week price range of $1.50 – $2.97 and shows ongoing negative price momentum by trading below its 20-day (1.76) and 50-day (1.79) moving averages. The stock trades at a relative discount, based on a P/S ratio of 1.6x compared to the Specialty & Generic Drug Manufacturers industry average of 2.2x.

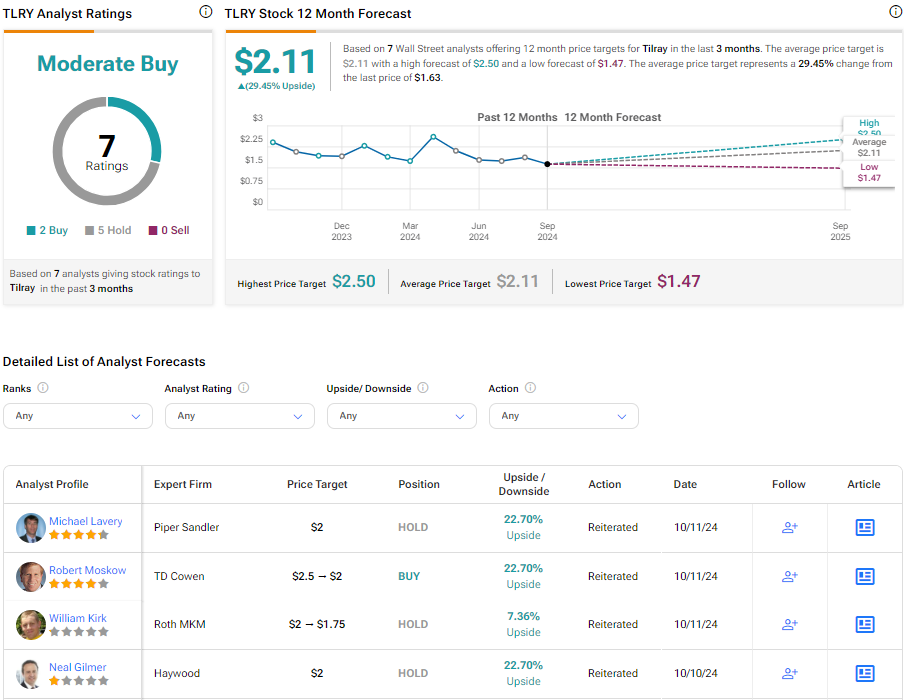

Analysts following the company have been cautiously optimistic about TLRY stock. Based on the recent recommendations of seven analysts, Tilray is rated a Moderate Buy. The average price target for TLRY stock is $2.11, representing a potential upside of 29.45% from current levels.

Final Thoughts on Tilray

As a new era of regulation shifts towards a more cannabis-friendly global market, Tilray is positioned to benefit. The company’s robust and varied product line is expanding its global reach, particularly in the U.S. market, where the company has strategic plans for further expansion. Despite missing expectations, Tilray showed solid recent growth in net revenue, gross profit, and declining net loss. The stock offers value-oriented investors an intriguing window of opportunity.