SoundHound AI (NASDAQ:SOUN) has captured significant attention this year, riding the wave of the AI sector’s rapid growth. Even after a pullback from its earlier highs, SOUN stock remains up 143% year-to-date.

And according to Wedbush analyst Daniel Ives, there’s plenty more to come. Ives’ positivity comes in the wake of the voice recognition specialist’s Q2 readout, with the company beating expectations both on the top-and bottom-line.

Based on ongoing strength in both automotive and restaurants, revenue rose by 54% year-over-year to $13.5 million, just edging ahead of the Street’s $13.1 million forecast. Meanwhile, the bookings backlog reached $723 million, amounting to a ~100% y/y increase on account of robust product royalties and a strong performance in the automotive sector as both new and current customers show growing interest in its Chat AI platform. On the bottom-line, EPS of ($0.04) fared better than the Street’s forecast of ($0.09).

Adding further sheen, the company announced it will acquire AI software firm Amelia for $80 million in cash and equity. With $45+ million in recurring AI software revenue, Ives thinks the purchase will “improve SOUN’s position within voice and conversational AI while expanding into new verticals such as retail, financial services, healthcare, smart devices, and more.” As such, SOUN now expects full year 2024 revenue to surpass $80 million vs. the $65.0 million – $77.0 million range expected beforehand.

Looking at the big picture, Ives takes an upbeat view of SOUN’s prospects. “Overall,” the analyst said, “we believe this was another major step in the right direction for SOUN as we view the Amelia acquisition as a strategic move by significantly expanding the company’s reach into new large TAM markets while notably expanding its growth trajectory with stable revenue pillars across Automotive/Restaurant and strong monetization capabilities to capture demand from enterprises across industries.”

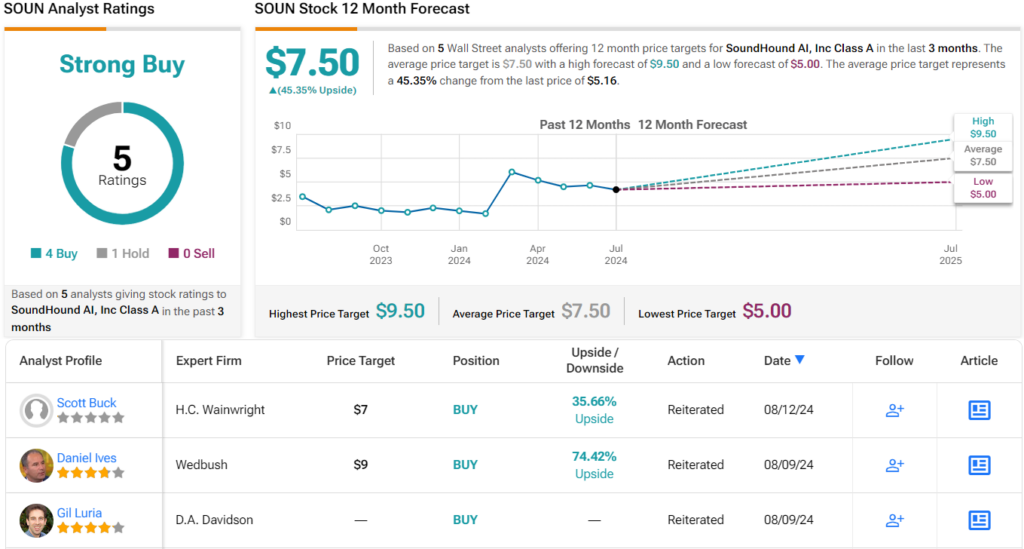

To this end, Ives rates SOUN shares an Outperform (i.e. Buy), along with a $9 price target, implying the stock will climb another 74% higher from here. (To watch Ives’ track record, click here)

Most on the Street agree with Ives’ bullish stance. Based on a mix of 4 Buys vs. 1 Hold, the stock claims a Strong Buy consensus rating. The forecast calls for 12-month returns of 45%, considering the average price target stands at $7.50. (See SOUN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.