Scientific instrumentation and software services provider Thermo Fisher Scientific Inc. (NYSE: TMO) recently announced a quarterly dividend of $0.30 per share, a 15.4% increase from the previous dividend of $0.26 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The dividend will be paid on April 14, 2022, to shareholders of record as of March 16, 2022.

The company’s annual dividend of $1.2 per share now reflects a dividend yield of 0.2% based on Wednesday’s closing price.

Notably, the company has been raising its dividend consistently over the past four years, making it an attractive choice for investors.

Stock Rating

Recently, Cowen & Co.analyst Daniel Brennan reiterated a Buy rating on the stock. The analyst, however, raised the price target from $715 to $736, which implies upside potential of 39.2% from current levels.

Consensus among analysts is a Strong Buy based on 6 Buys and 1 Hold. The average Thermo Fisher stock prediction of $690.43 implies upside potential of 30.6% from current levels. Shares have gained 15.8% over the past year.

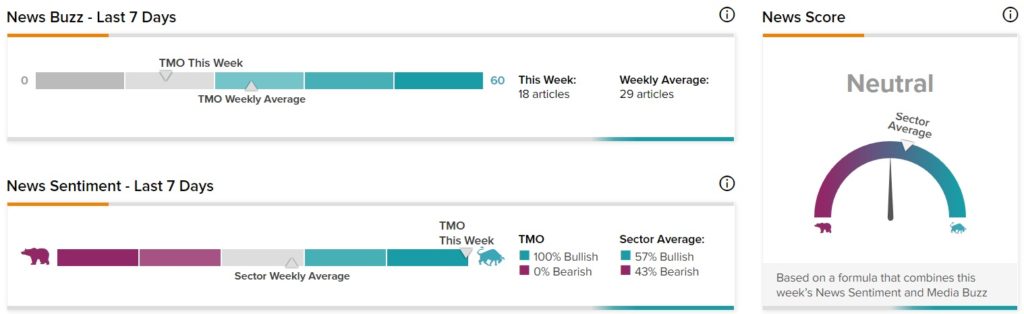

News Sentiment

News Sentiment for TMO is Neutral based on 18 articles over the past seven days. 100% of the articles have Bullish sentiment, compared to a sector average of 57%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Palo Alto Networks Beats Q2 Expectations; Shares Up 6.4%

MercadoLibre Pops 9.5% on Strong Q4 Results

U.S. Bancorp Collaborates with Microsoft