MicroStrategy (NASDAQ:MSTR) shares’ incredible run has brought its year-to-date gains to ~540%, making it the ultimate Bitcoin play.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

In fact, it is not only the best Bitcoin stock, but it has also been the best-performing name amongst Fortune 500 firms since the company implemented its Bitcoin acquisition strategy in the summer of 2020, recording a gain of ~2,800% over the period.

As Canaccord analyst Joseph Vafi notes, “These outsized gains have outpaced even leading AI stories, including NVDA.”

Vafi, who ranks amongst the top 2% of Wall Street analysts, says the valuation discussion around MSTR shares is “a unique one.” It is rare to find a software company where the stock price is mostly driven by the current value and sentiment around investments held on the balance sheet. “In the case of MSTR,” the 5-star analyst went on to say, “the Bitcoin-focused capital allocation strategy undertaken has driven material shareholder value and is a testament to this forward-thinking approach, in our view.”

Nevertheless, many investors have been “scratching their heads” when looking at MSTR using “traditional valuation lenses.” However, Vafi thinks these approaches don’t fully capture the story. Metrics like EV/EBITDA no longer apply to MSTR, as its software business makes up only a small fraction of its current enterprise value. That said, while the sum of the parts (SOTP) method, which adds in the value BTC on the balance sheet, is a better approach than profit ratios, it still doesn’t provide the complete picture.

That’s because while an SOTP analysis shows the premium or discount at which MSTR’s stock trades relative to its bitcoin holdings, it doesn’t account for how MSTR’s ongoing bitcoin purchases are adding value. “Thus,” says Vafi, “while equity premium is indeed a risk factor, it is also an opportunity to buy bitcoin accretively, and that is what MSTR has been doing in larger and larger quantities.”

So, Vafi’s new way to “gauge MSTR value creation” is to focus on Bitcoin accretion per share and the Bitcoin yield KPI.

Ok, so what does that mean? By leveraging both equity and convertible debt while “exploiting its equity premium,” MicroStrategy has been able to grow its bitcoin holdings faster than its share count, which is being diluted. The company now reports its Bitcoin yield, a metric introduced earlier this year, which measures the growth in Bitcoin holdings per share. For instance, as of November 18, MSTR’s 2024 year-to-date BTC yield was 41.8%, meaning the number of bitcoins per share grew by that percentage. This growth in bitcoin holdings, combined with gains in the spot price of bitcoin, leads to significant “dollarized” accretion per share that isn’t reflected in the P&L.

“We believe that this dollarized BTC accretion per share captures everything going on at MSTR (risk/ reward from the equity premium, spot price of BTC, accretive equity/debt purchases of BTC, the BTC KPI yield, etc),” Vafi further said.

So, how does this all pan out for investors? Vafi gives MSTR shares a Buy rating, while raising his price target from $300 to $510, suggesting the stock has room to climb 26% higher from here. (To watch Vafi’s track record, click here)

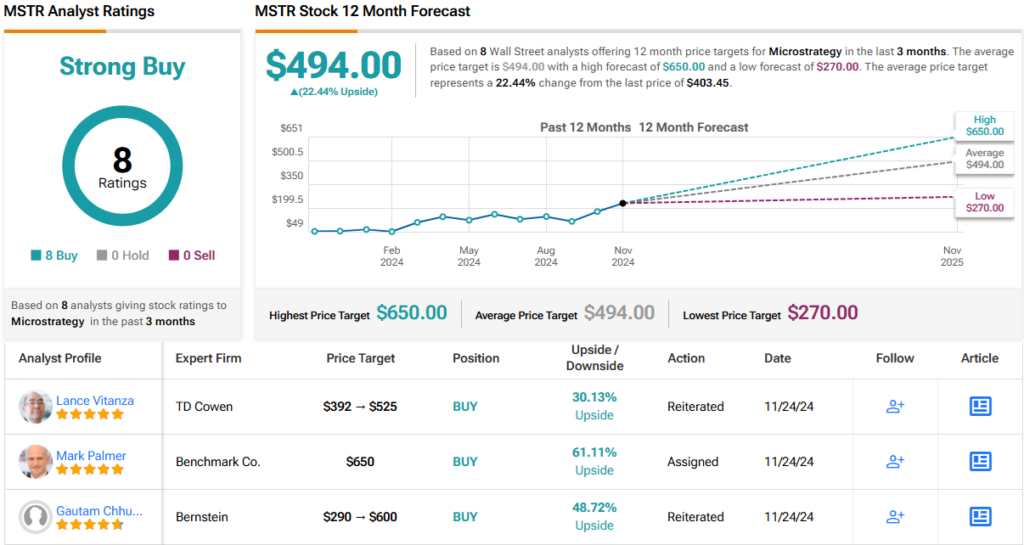

All in all, based on a unanimous 8 Buy recommendations, the stock claims a Strong Buy consensus rating. Meanwhile, the $494 average price target suggests the shares will surge ~22% over the next 12 months. (See MSTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.