4.6-star analyst Michael Morris of Guggenheim believes that Roku (ROKU), the entertainment company that makes its own hardware, could be a bigger draw than expected. Already, some are taking Morris’ words seriously, and Roku shares gained fractionally in the closing minutes of Monday’s trading. Basically, Morris likes what’s going on at Roku and thinks that a lot of other traders are missing a few key points.

Morris backed up his assessment by boosting Roku’s rating to Buy and establishing a $75 price target. Morris had previously held a rating of Neutral on Roku, and that rating has been in place since November 2022.

So what changed? As Morris puts it, “…several positive potential drivers for Roku revenue that we believe are underappreciated.” These include a marked increase in original content, which should generate more ad revenue. The new arrival of home screen ads should also light a fire under earnings, Morris noted. While it won’t help matters that the consumer is under pressure, which is prompting some retraction in ad spending, there will still be shoppers who need to be advertised to.

It’s worth noting that, so far, Morris has enjoyed a 52% success rate on his stock ratings, with an average return of 12.7% per rating.

Hard-to-Find Content Could Help Roku

Another point that Morris does not mention but could help Roku, in the long run, is unoriginal content that is simply hard to find. Some content is difficult to find to watch outside of Roku, from old series to old movies, noted a report from TV Insider. Three different comedies, 2 Broke Girls, Kate and Alley, and Coach, are apparently not located on several other streaming services. Original content will help Roku…but old reruns no one has seen before may have a similar impact and be more readily available.

Is Roku a Buy, Sell, or Hold?

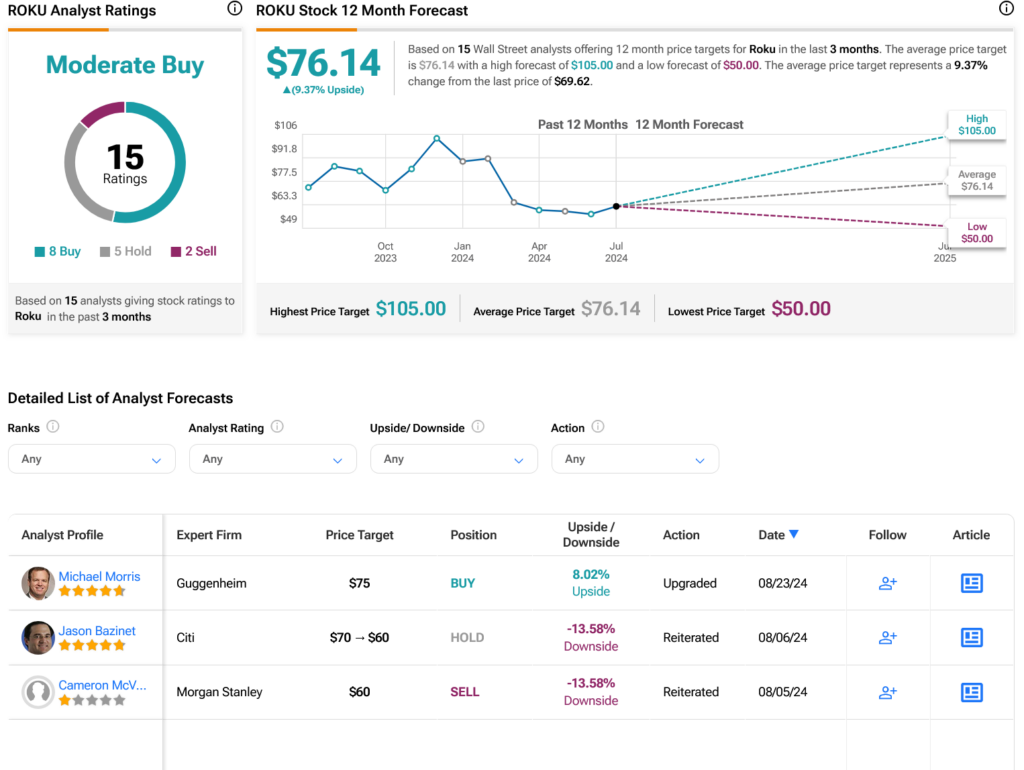

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ROKU stock based on eight Buys, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 9.51% loss in its share price over the past year, the average ROKU price target of $76.14 per share implies 9.37% upside potential.