A shortage of shipping containers throughout the manufacturing and distribution processes has the potential to drive up inflation rates significantly. While these large, unattractive steel containers may go unnoticed by the average consumer, the role of shipping container manufacturers becomes vital in controlling inflation. This importance is highlighted by the fact that a lack of availability can trigger material shortages and price inflation, ultimately leading to an overall reduction in living standards due to increased costs and limited access to goods

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Shipping Containers Are a Vital Trade Component

Intermodal containers, the official name, are used in shipping, thus playing an integral role in transporting the products we use in our daily lives. The high volume of global trade today is made possible only by the lower transportation costs, the speed at which products and materials can be shipped, and the relatively minimal damage to the cargo that the containers provide.

Moreover, the use of containers for shipping has enabled the uniform integration of global supply chains. This integration allows businesses to source materials and components from the most cost-effective locations and then ship them worldwide. The benefits of container shipping include increased competition, lower overall prices for consumers, and higher economic growth for trading partners worldwide.

As a result, global supply chains, defined as the ability to send and receive goods or materials where needed, are vastly improved by the existence of utilizing intermodal containers.

How Shipping Containers Impact Inflation Rates

Containers are essential in securing low inflation by their ability to maintain efficient and competitive global trade. When container availability is balanced and distribution is at its most effective, businesses can keep costs low and pass the savings on to consumers by holding prices at a minimum. For this reason, any disruptions in container availability, replenishment, or new production can lead to increased costs and delays in the delivery of goods. These costs would likely be added to the end price of both wholesale and retail goods as inflation.

Interestingly, it wasn’t long ago that the supply chain disruptions during the pandemic helped create below-demand container availability that led to skyrocketing shipping costs and delays in the delivery of goods. Even before the reopened Covid-economy caused a demand for consumer goods, the supply of shipping containers fell behind what was needed for healthy commerce, and because of this, inflation ticked higher.

Which Container Manufacturer Shares Are a Buy?

There are a number of companies that manufacture containers whose shares are publicly traded.

Considering container manufacturers as an investment option may be appealing when supply chains face disruptions. Purchasing new shipping containers is a more cost-effective approach than facing the situation where existing containers are unavailable to ship or receive goods. Therefore, when it becomes difficult to replenish the existing containers due to logistical challenges, procuring new containers is a practical and economical solution to ensure continuous business operations.

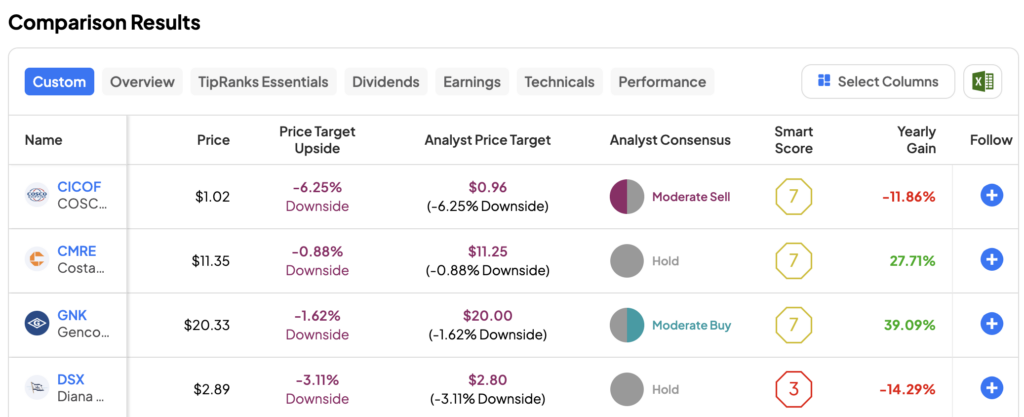

Some intermodal shipping container manufacturers and shipping companies that integrate containers and container leasing into their business revenue streams are COSCO Shipping (OTCMKT:CICOF), Costamere (NYSE:CMRE), Genco Shipping (NYSE:GNK), and Diana Shipping (NYSE:DSX).

By scanning the TipRanks Stock Comparison Tool below we can see that analyst opinions on opportunities in this sector are mixed, and include various Buy, Sell, or Hold Analyst Consensus depending upon the individual company. As of now, GNK stock is a Moderate Buy and has gained 39.09% over the past year.

Read full Disclosure