High-end consulting and engineering services provider Tetra Tech, Inc. (TTEK) has acquired Axiom Data Science, which provides management and analysis of oceanic and ecological data related to climate change.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Axiom’s climate science modeling enables customers to manage, integrate, and visualize large-scale, complex data sets that are critical to climate change.

This acquisition further bolsters Tetra Tech’s high-end climate data analytics expertise. While the transaction terms remained undisclosed, Axiom will join Tetra Tech’s Government Services Group.

Management Weighs In

The Chairman and CEO of Tetra Tech, Dan Batrack, commented, “The addition of Axiom Data Science expands our high-end advanced analytics capabilities in oceans and ecosystems to advance climate science for clients, including the National Oceanic and Atmospheric Administration and the National Aeronautics and Space Administration.”

Founder and CEO of Axiom, Rob Bochenek, added, “By joining Tetra tech, we will further enhance our ability to provide highly specialized solutions to our clients while offering new opportunities for our employees to work on water and environment programs worldwide.”

Additionally, this month Tetra Tech also acquired Vancouver-based Piteau Associates in a move to expand its sustainable water management practice. Piteau is a leader in sustainable natural resource analytics.

Analysts’ Take

Recently, Stifel Nicolaus analyst Noelle Dilts reiterated a Buy rating on Tetra Tech alongside a price target of $184 implying a potential upside of 20.6%. Overall, the Street has a Moderate Buy consensus rating on Tetra Tech based on 2 Buys and 1 Hold. The average Tetra Tech price target of $187.33 implies a potential upside of 22.8% for the stock.

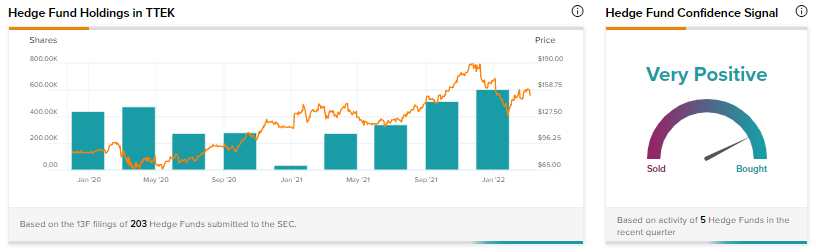

Hedge Fund Activity

According to TipRanks data, Wall Street’s top hedge funds have increased holdings in Tetra Tech by 89.2 thousand shares in the last quarter, indicating a very positive hedge fund confidence signal in the stock based on activities of 5 hedge funds. Notably, Richard Driehaus’ Driehaus Capital Management has a holding worth ~$43.3 million in Tetra Tech. Shares are up 17.4% over the past 12 months.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

bluebird bio Reports Quarterly Loss, Provides Clinical Updates

Bed Bath & Beyond Jumps over 34% on Cohen’s Stake Disclosure

Citigroup on Hiring Spree, Plans to Expand Global Workforce