Tesla (TSLA) is set to launch its highly anticipated robotaxi, named Cybercab, on October 10 at an event at Warner Bros. Studios in Burbank, Los Angeles. The event, titled “We, Robot,” will highlight Tesla’s latest advancements in autonomous driving technology.

It should be noted that the Cybercab’s debut was initially scheduled for August 8 but was postponed at the request of CEO Elon Musk. He believed that the design required further modifications and additional features before it was ready for release.

Robotaxi Takes Center Stage

Musk’s decision to prioritize the Robotaxi project over a planned low-cost Tesla model reflects the company’s strategic focus on autonomous driving technology. While details about the Cybercab remain limited, it is expected to resemble the design of the Cybertruck, TSLA’s pickup truck.

Importantly, the launch of Cybercab could influence the ride-sharing sector by challenging established services like Uber (UBER) and Lyft (LYFT). Tesla’s robotaxi will also compete with established players such as Alphabet’s (GOOGL) Waymo and General Motors (GM) Cruise.

The success of Tesla’s initiative will depend on its ability to effectively roll out its robotaxis and achieve high levels of driving autonomy.

Analysts’ Opinions About the Event

Several Wall Street analysts have shared their views on what to expect from Tesla’s upcoming event. Let’s take a look at some of them:

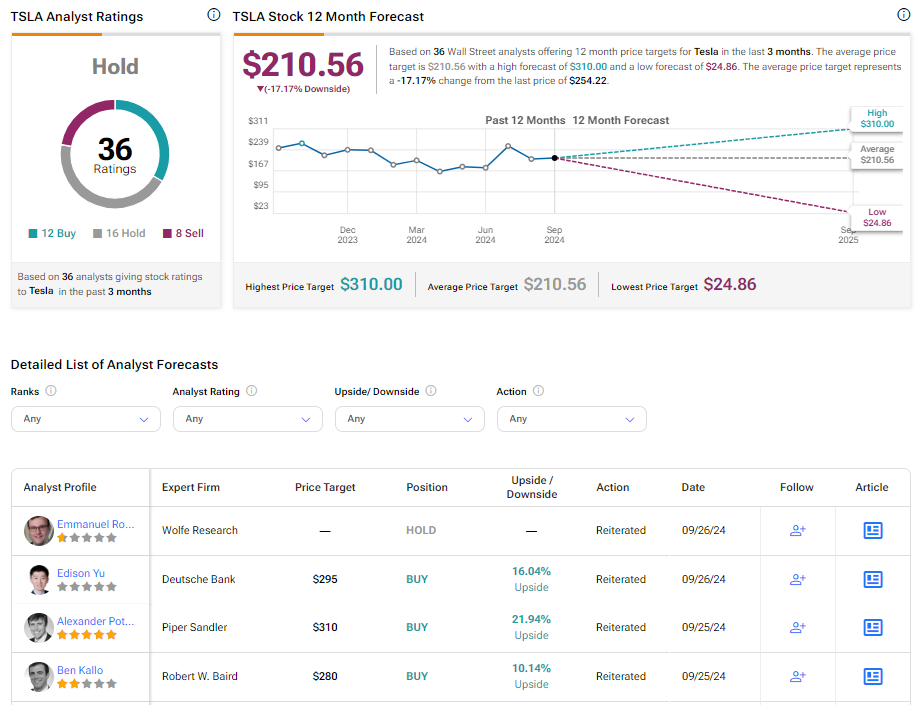

- Edison Yu of Deutsche Bank: Yu is looking forward to updates on Tesla’s robotaxi program at the upcoming event. He maintains a Buy rating for Tesla stock, but expresses caution regarding potential market uncertainty that may arise after the event.

- Emmanuel Rosner of Wolfe Research: Rosner noted that Tesla is making strides toward fully autonomous driving and is developing a strong infrastructure to support this technology. He maintained a Hold rating on the stock.

As Tesla prepares to launch its latest autonomous driving technology, investors will be closely watching to see if the company can meet the high expectations surrounding this much-anticipated event.

Is Tesla a Buy, Hold, or Sell Right Now?

Turning to Wall Street, TSLA stock has a Hold consensus rating based on 12 Buys, 16 Holds, and eight Sells assigned in the last three months. At $210.56, the average Tesla price target implies 17.17% downside potential. Shares of the company have gained 41.37% in the past six months.